Bizz View

Bus Operator Financial Model

Bus Operator Financial Model

Couldn't load pickup availability

his professional and user-friendly 10-Year Financial Model Template is designed specifically for bus transportation companies that generate revenue from both passenger fares and luggage services. It enables users to assess business viability, evaluate long-term financial performance, and support strategic planning and investment decisions.

The model captures all key financial and operational elements—such as fleet utilization, pricing, driver wages, fuel costs, vehicle acquisitions, and financing structure—empowering users to confidently forecast revenues, costs, cash flow, and profitability. It also includes built-in scenario analysis tools to test various assumptions and visualize their impact over a 10-year horizon.

Whether for startups, growing operators, or businesses seeking funding, the template offers a comprehensive and structured view of both short-term performance and long-term financial sustainability

Model Structure

Inputs

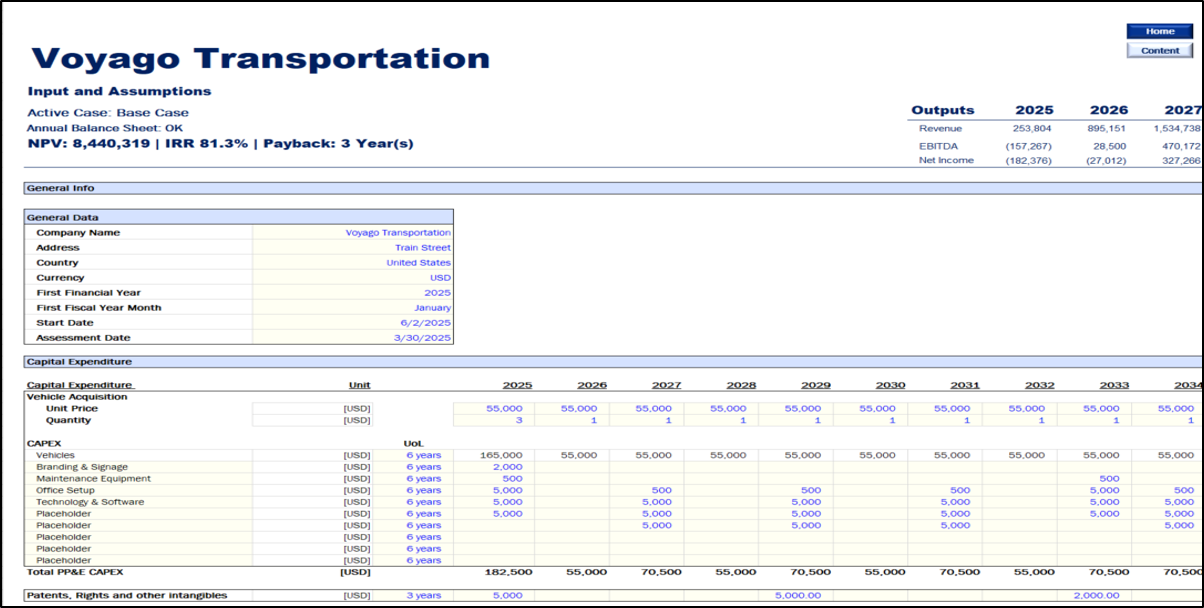

All inputs are clearly organized and editable, with yellow and blue-highlighted cells for easy user updates:

- General Assumptions: Buses in operation, trips per day, seating, fare structure, and luggage fees

- Revenue Drivers: Load factor, distance per trip, pricing per passenger and luggage

- Operating Costs: Driver wages, fuel usage and pricing, maintenance, and other direct costs

- Capex & Financing: Initial and future vehicle acquisitions, loan terms, and equity inputs

- Scenario Setup: Flexible input section to test Base, Best, and Worst cases

Calculations

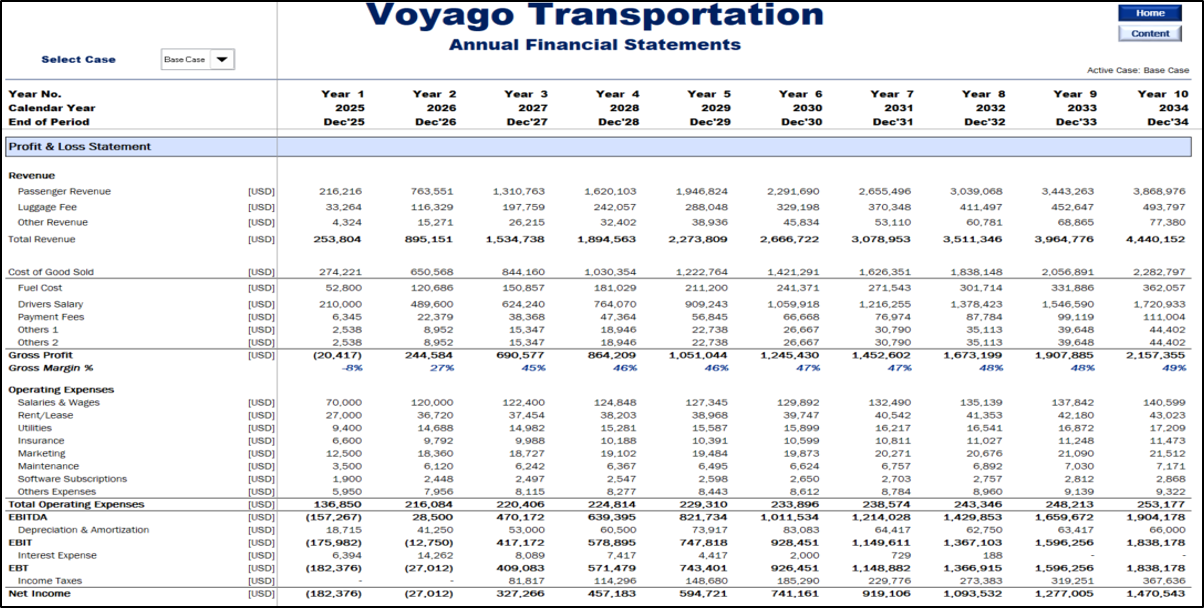

- Revenue & COGS: Calculates income and cost per trip based on volume, pricing, and distance

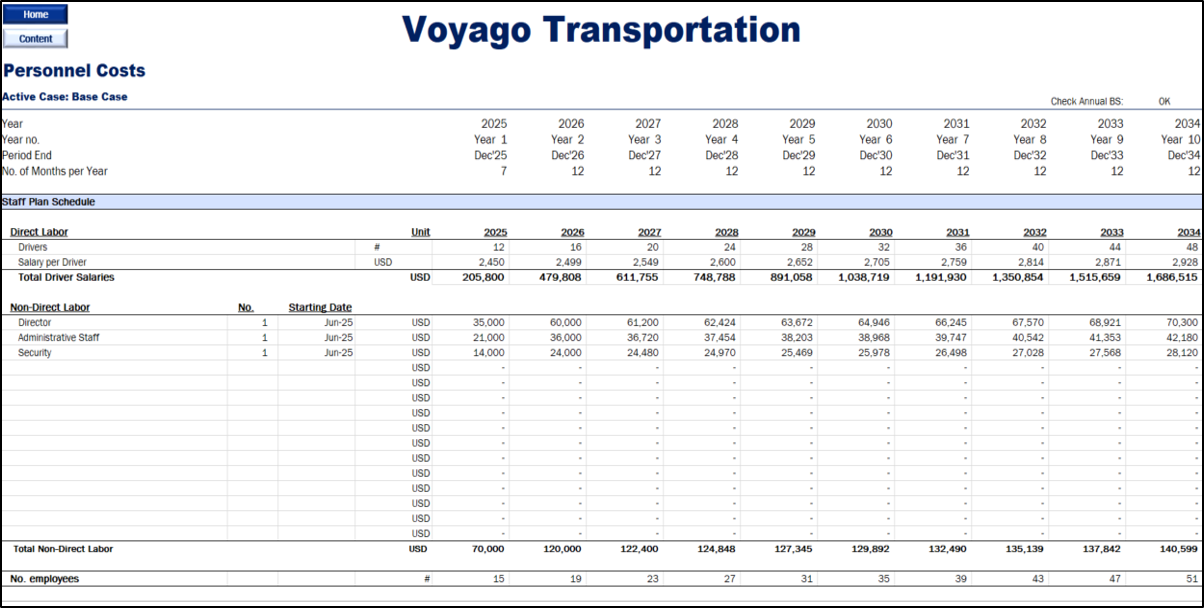

- Personnel Plan: Forecasts driver needs and salary costs over time

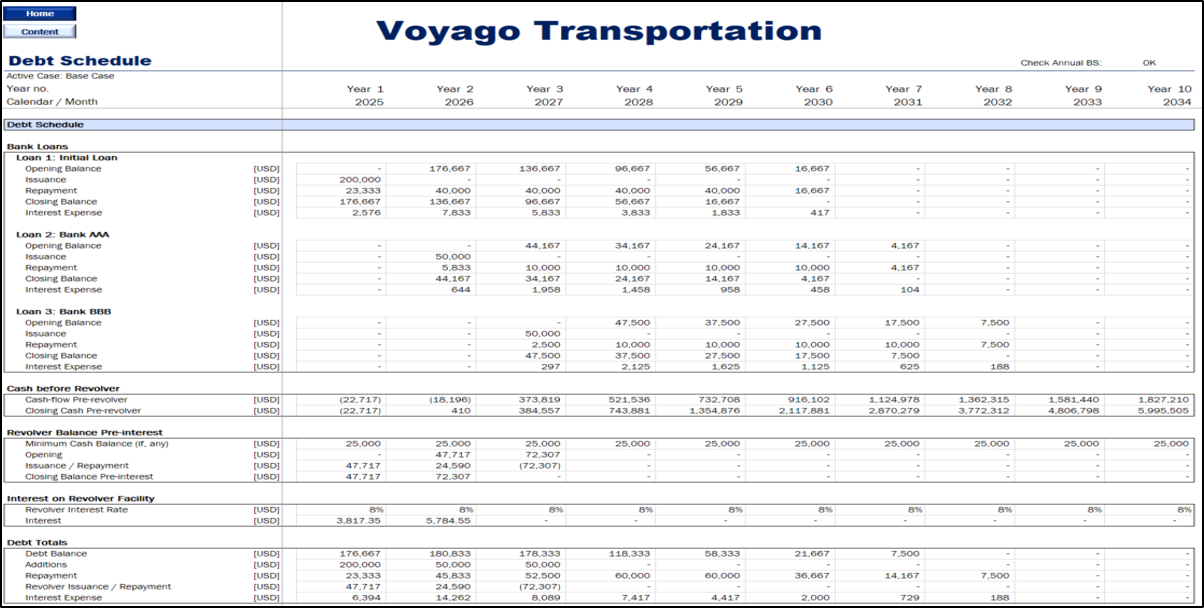

- Debt Schedule: Tracks loans, interest, and repayments over 10 years

- Other Calculations: Includes Opex, Equity Schedule, Working Capital requirements, and additional model logic

Outputs

- Executive Summary: High-level snapshot of key performance indicators for decision-making

- Monthly Financials: Monthly projections of income statement, balance sheet, and cash flow

- Annual Financials: 10-year summary for long-term analysis and investor reporting

- Actual + Forecast: Combines historical data with projections to track trends and performance

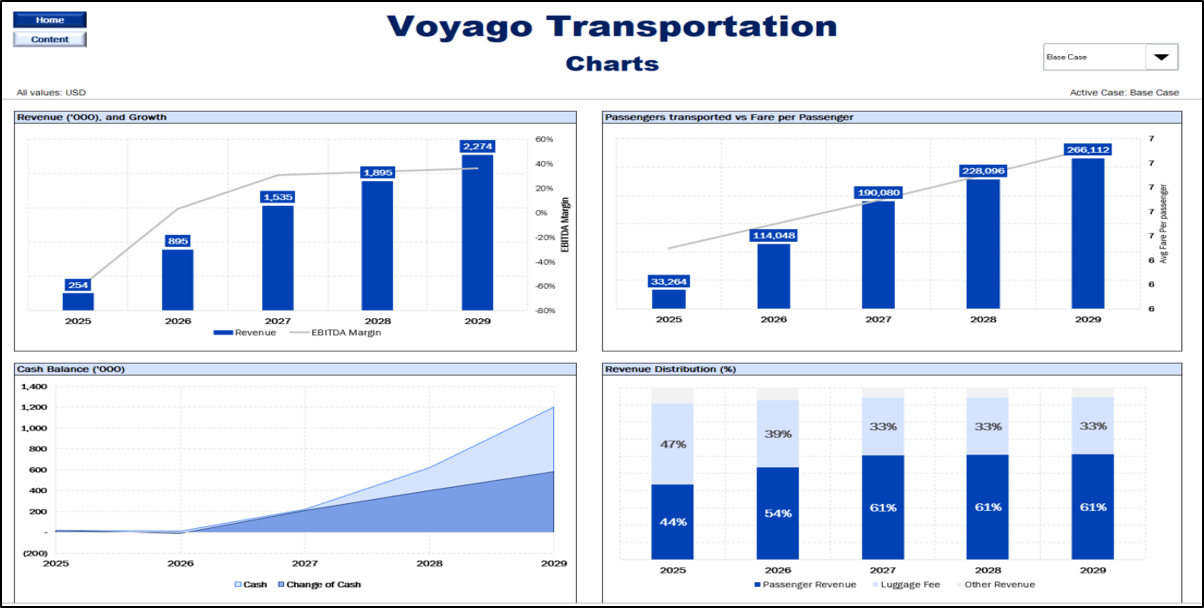

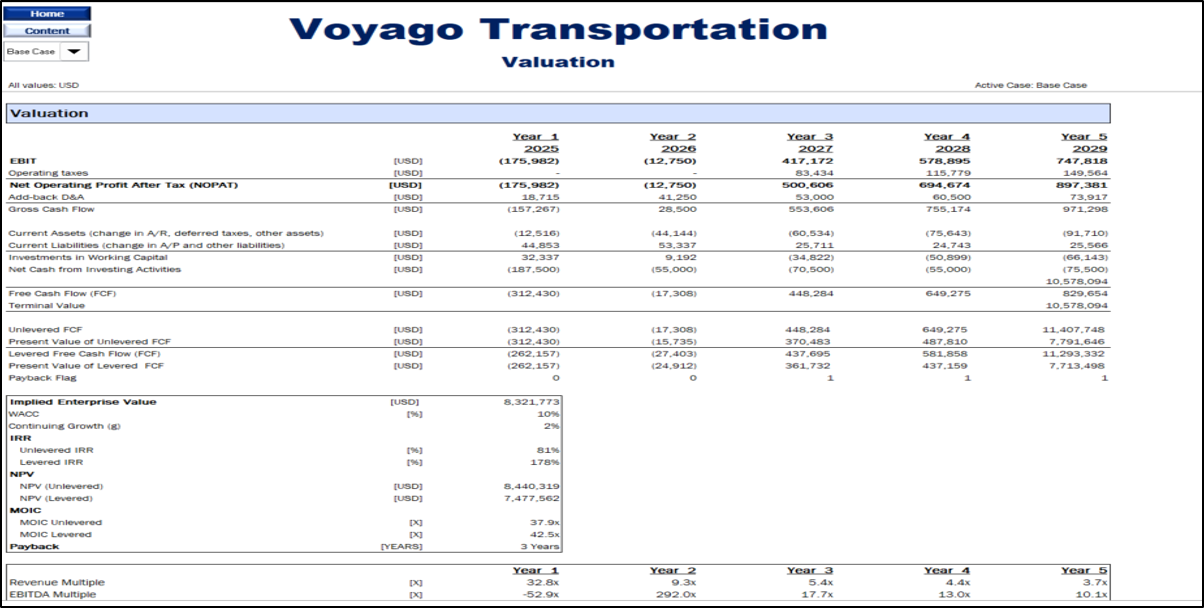

- Scenario Analysis: Side-by-side comparison of business cases with adjustable drivers

- Charts: Visual summaries of key financial metrics and trends

- Valuation: Business valuation using the Discounted Cash Flow (DCF) method

Features

- Instantly view updated financial outputs (income, cash flow, etc.) as you adjust assumptions

- Dedicated scenario comparison sheet with multiple cases side-by-side

- Fully customizable and prepared for print-friendly formatting

- Built using financial modeling best practices with clear structure and guidance throughout