Bizz View

Hotel - Eco Resort Financial Mode - Excel Financial Model

Hotel - Eco Resort Financial Mode - Excel Financial Model

Regular price

$50.00 USD

Regular price

Sale price

$50.00 USD

Unit price

per

Couldn't load pickup availability

The Resort Financial Model is an Excel-based tool for assessing the viability of investing in a Resort/Hotel business.

The model is expandable for up to 10 years and is 100% unlocked with transparent and easy-to-understand formulas that can be customized to the user's needs. The template is thoroughly adapted to the hospitality industry, considering the specificities and reporting standards of the sector.

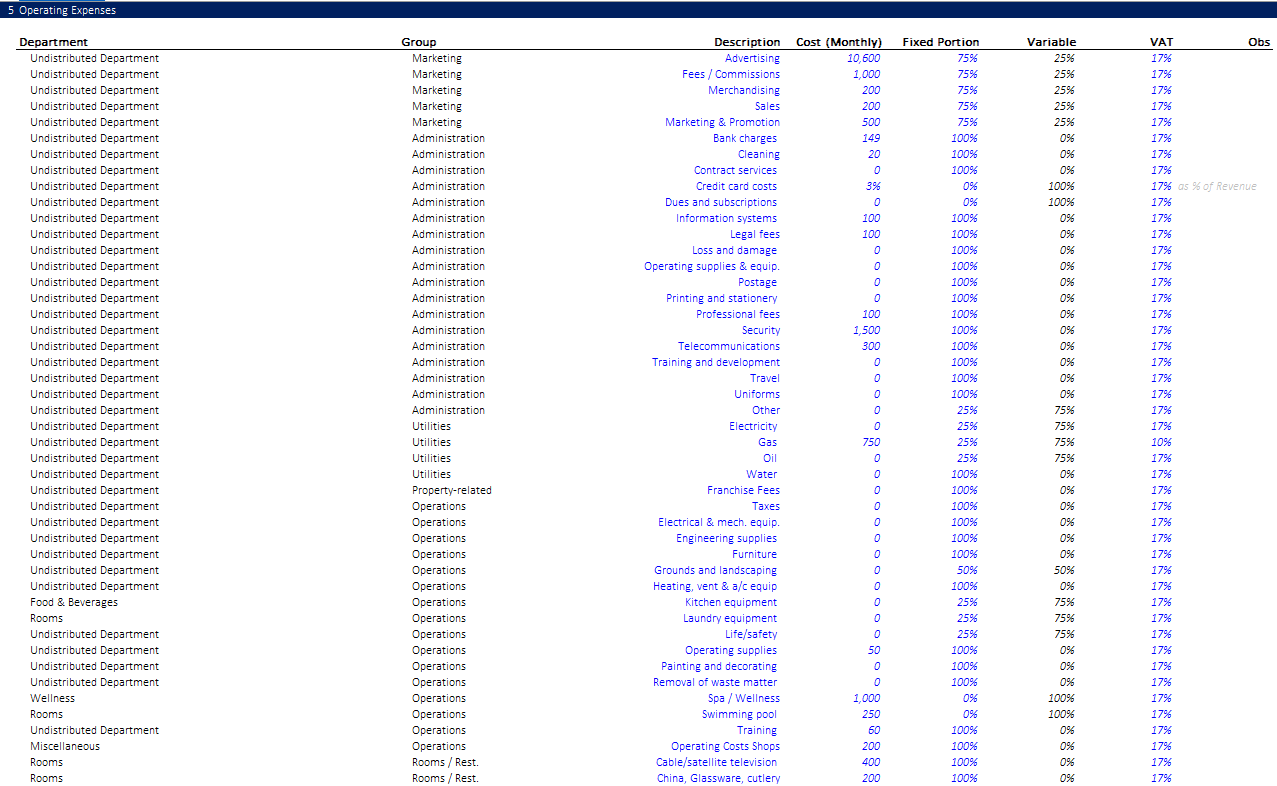

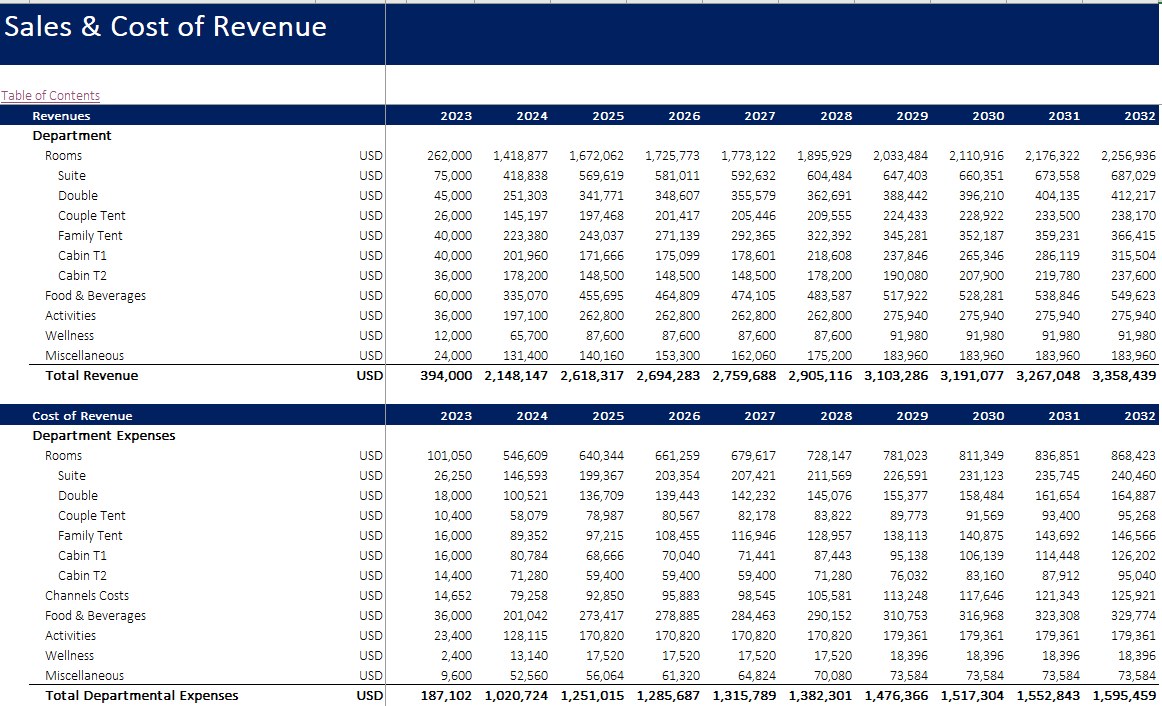

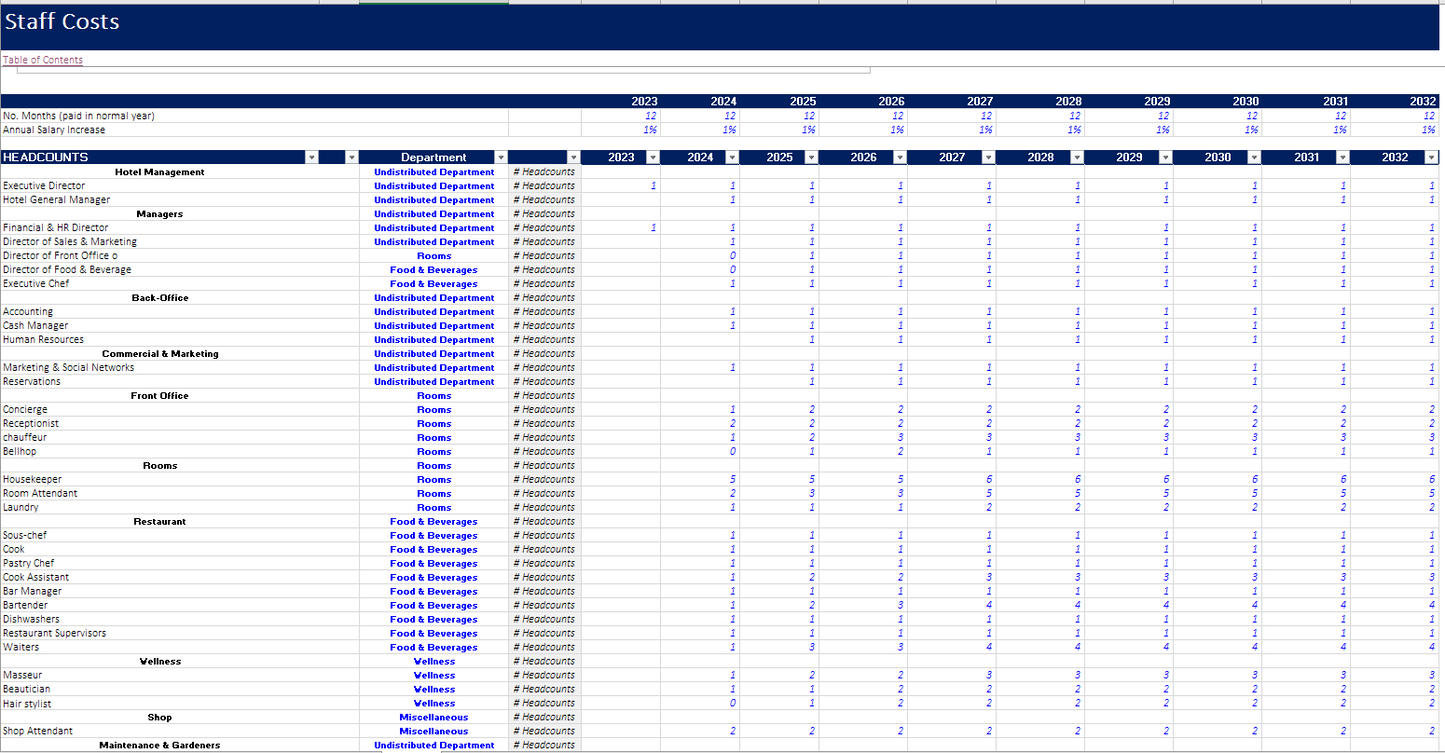

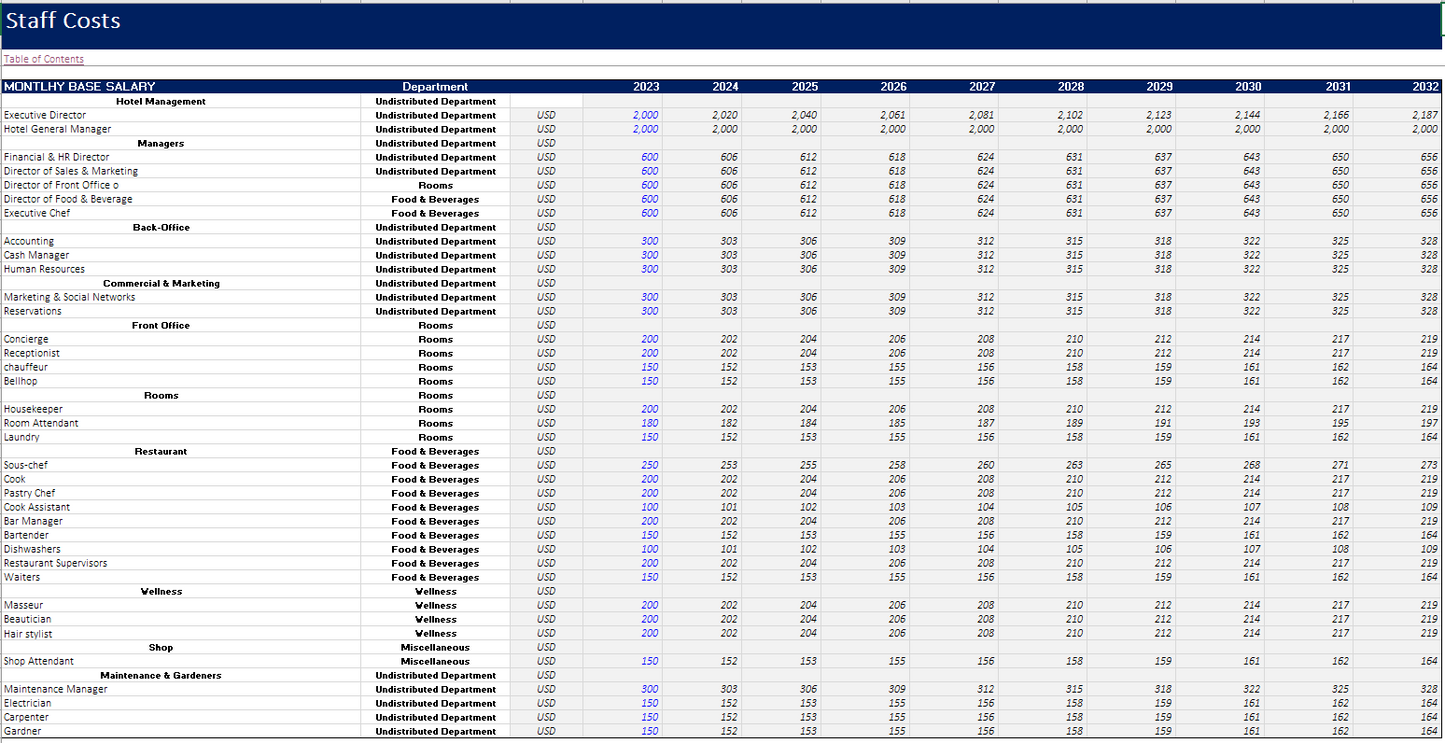

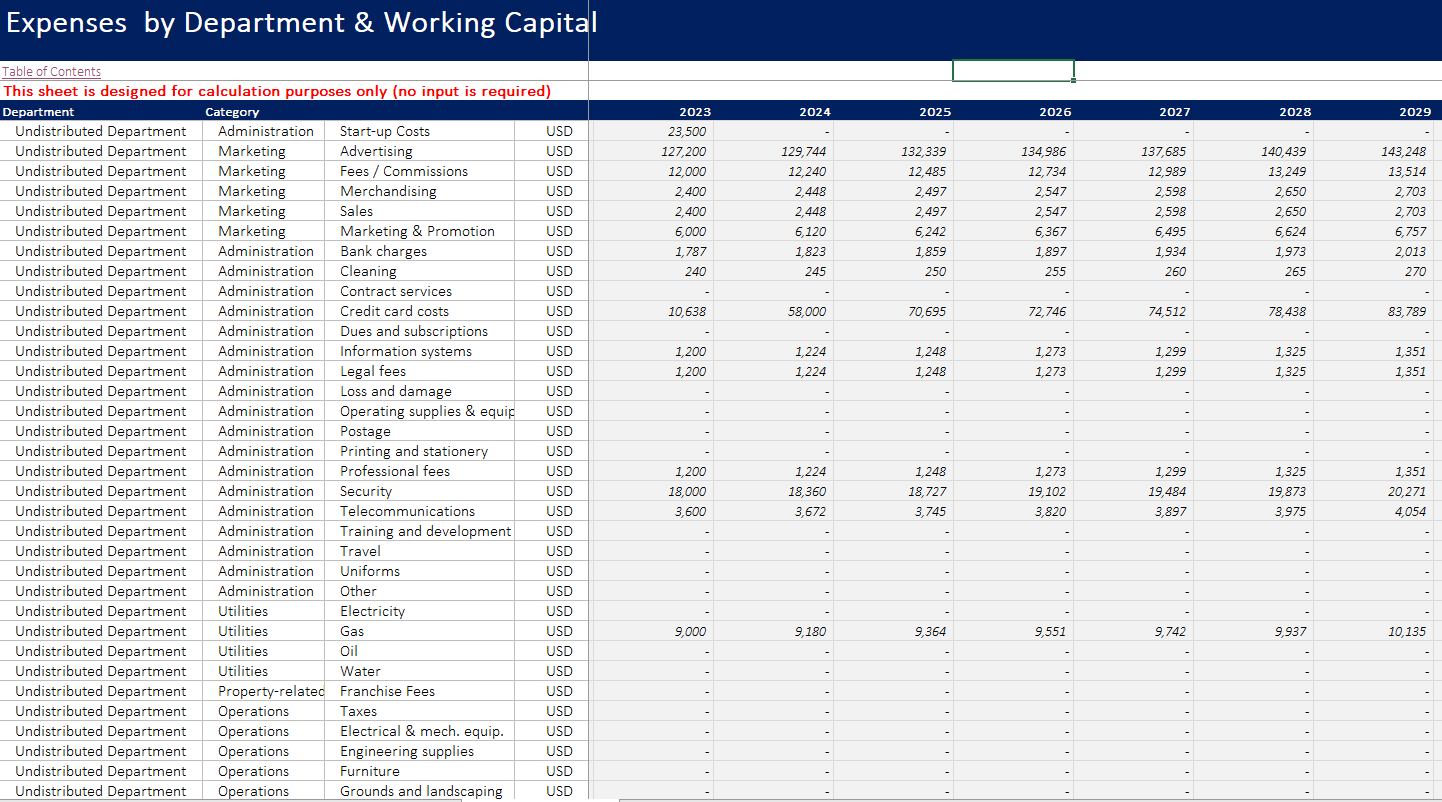

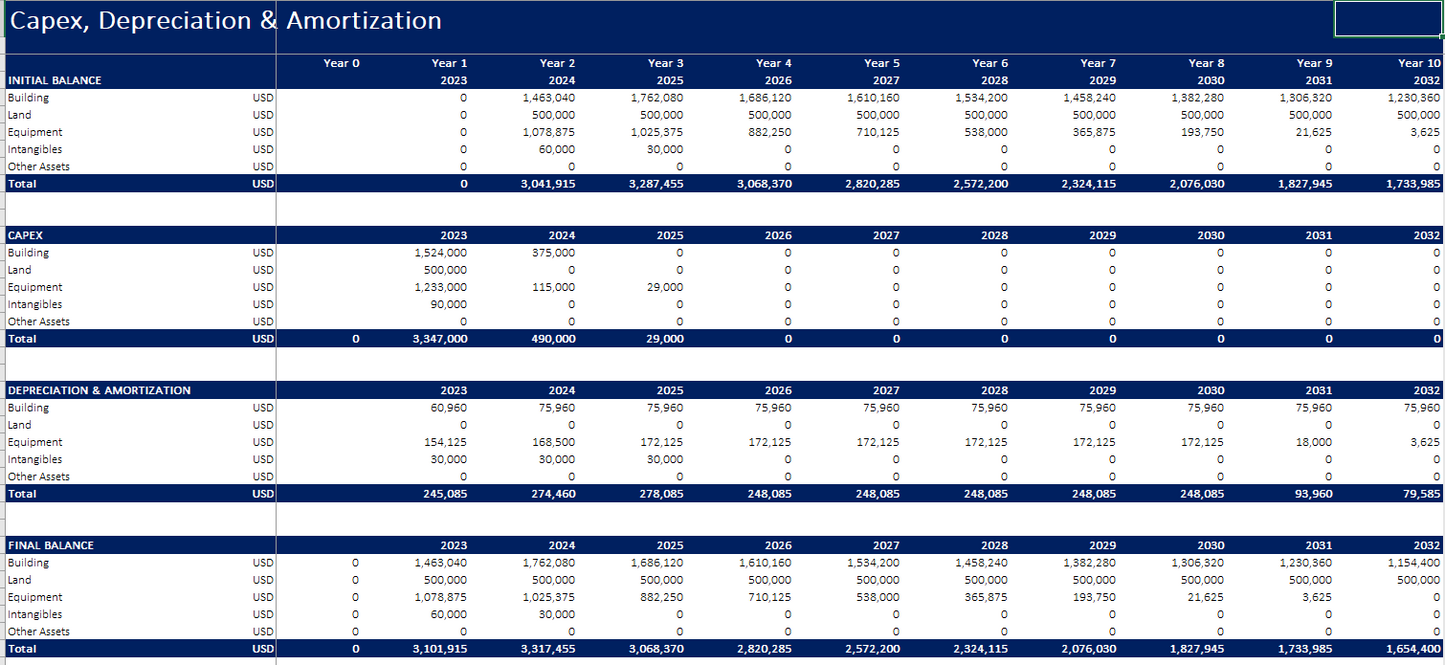

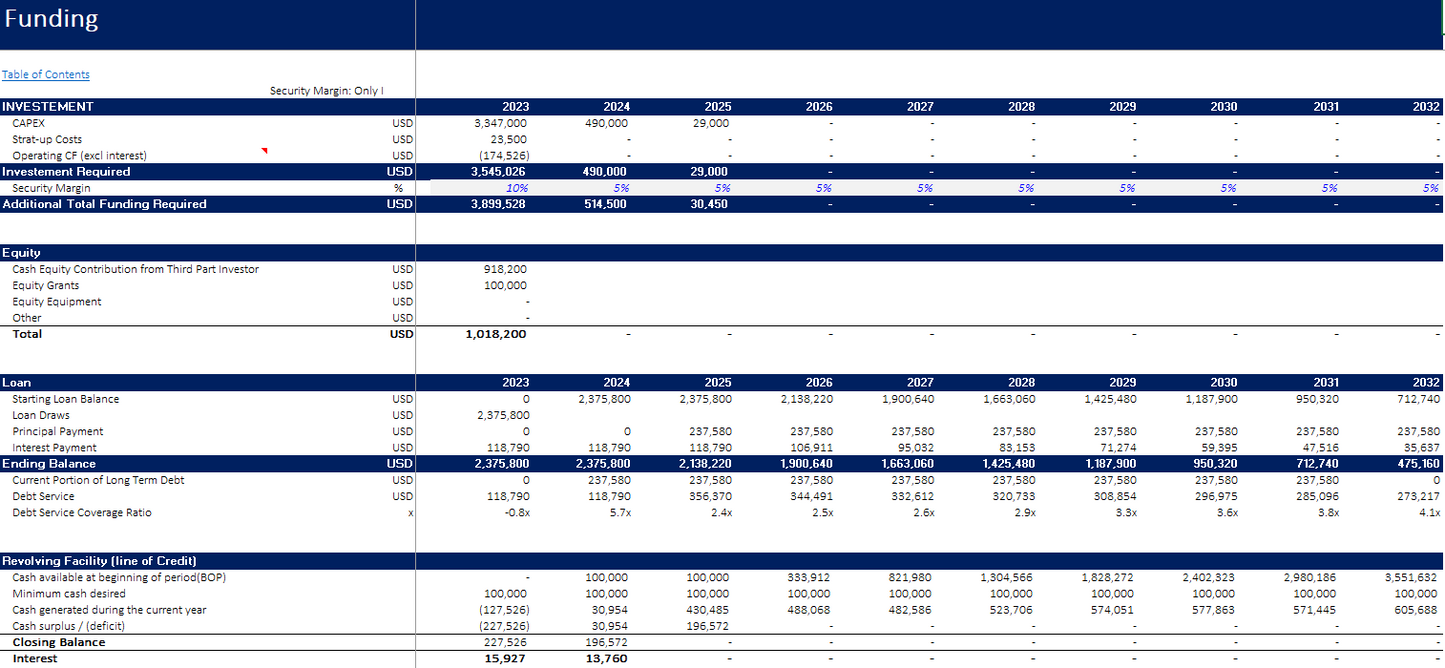

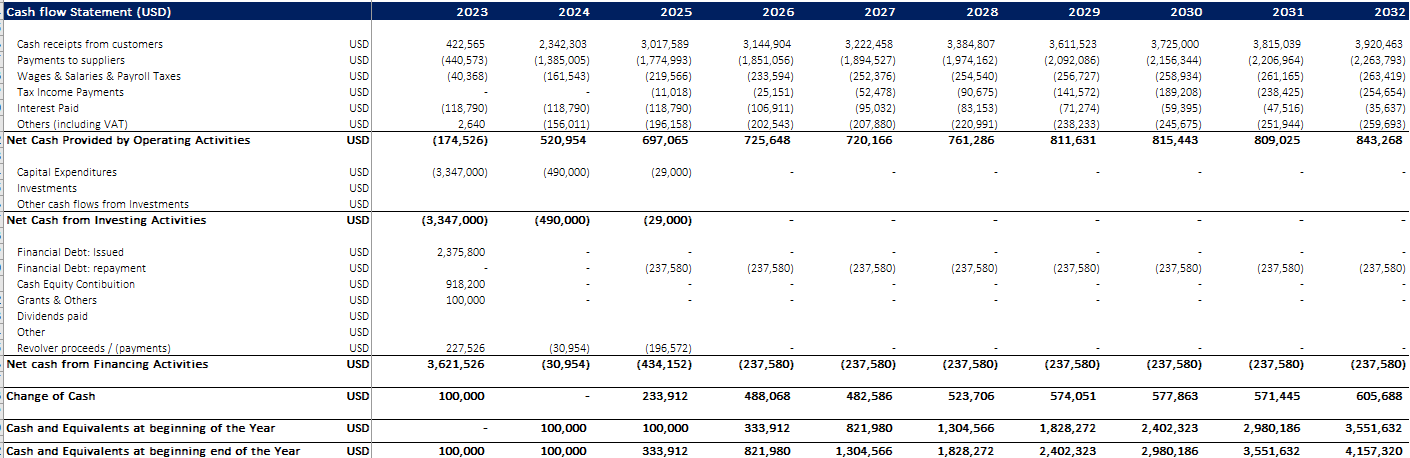

The model includes assumptions and calculations of several Revenue streams (Accommodation, Wellness activities, Food, and beverage), Cost of Sales, Payroll and Operating Expenses, Capital Expenditures, financing through Debt & Equity, and Revolving facility to cope with the operating shortfall, especially in the initial years, and business valuation multiples.

Instructions and explanations on the model use are included in the Excel file.

Model Structure

Almost all the assumptions are set up in the input sheet, including the following:

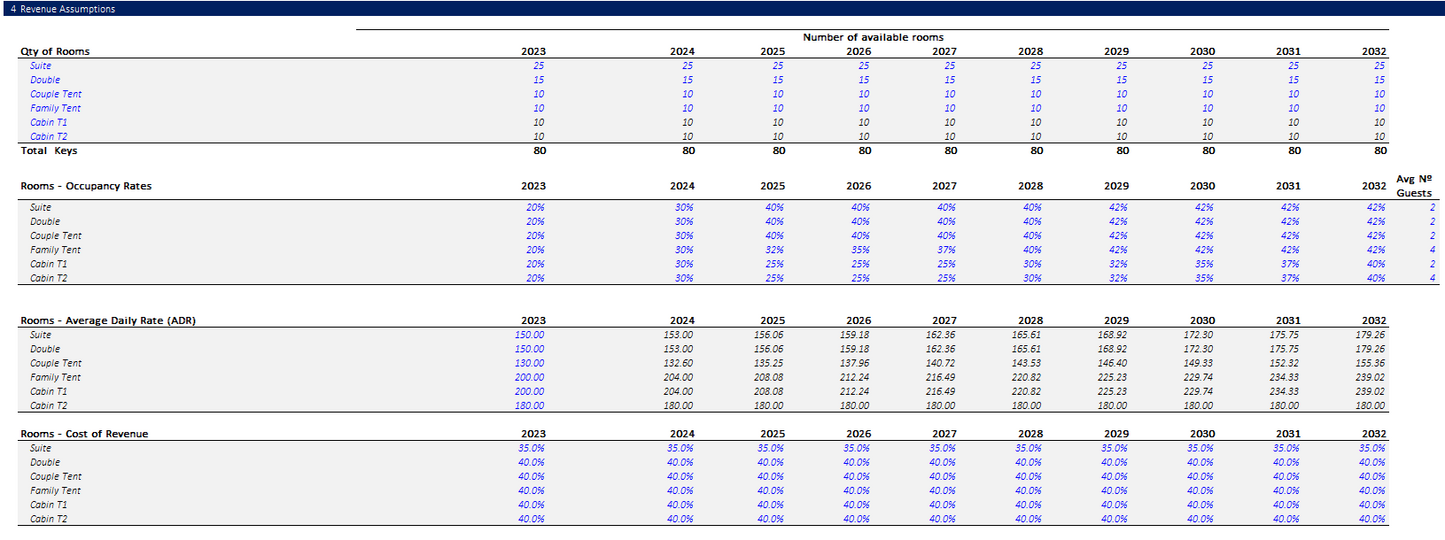

• Revenue & Cost of Sales Assumptions, including Operating Days, Occupancy Rate, Room Types & Prices, Ancillary Services, and Direct Costs (Commissions to TAs, Room Expense, Discounts & Promotions, etc.)

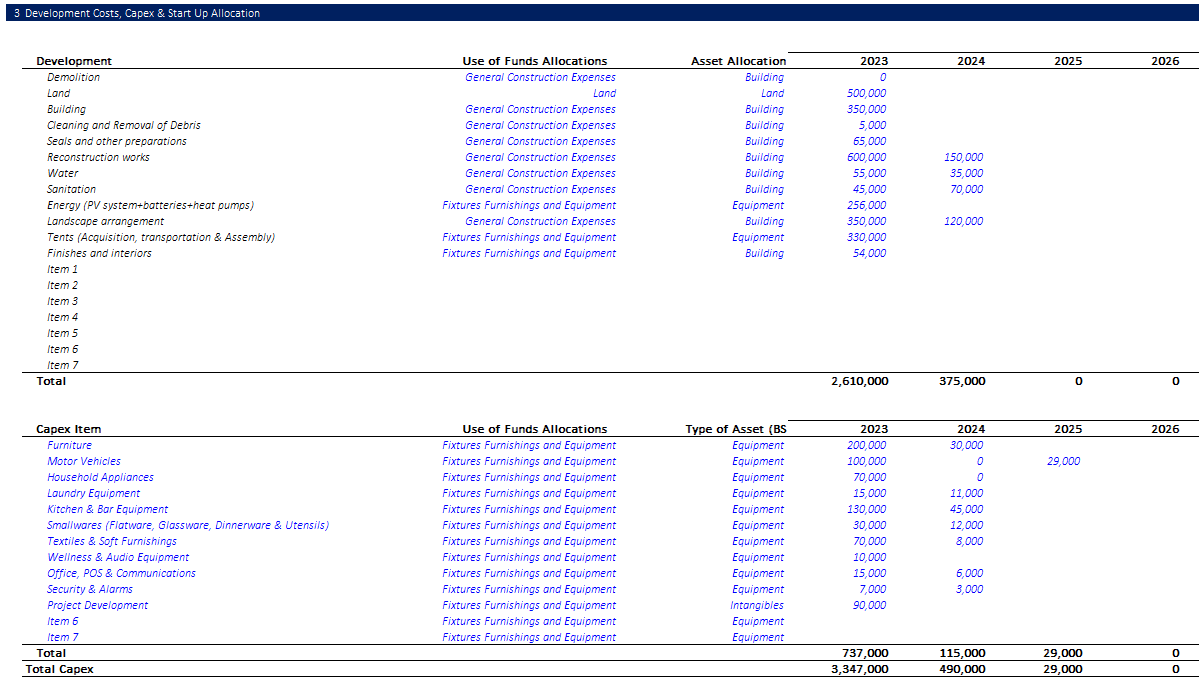

• Payroll, OpEx & CapEx Assumptions

• Financing & Capital Structure – Uses & Sources of Cash analysis (Financing through Equity & Debt)

• TAX; VAT, WACC

Outputs:

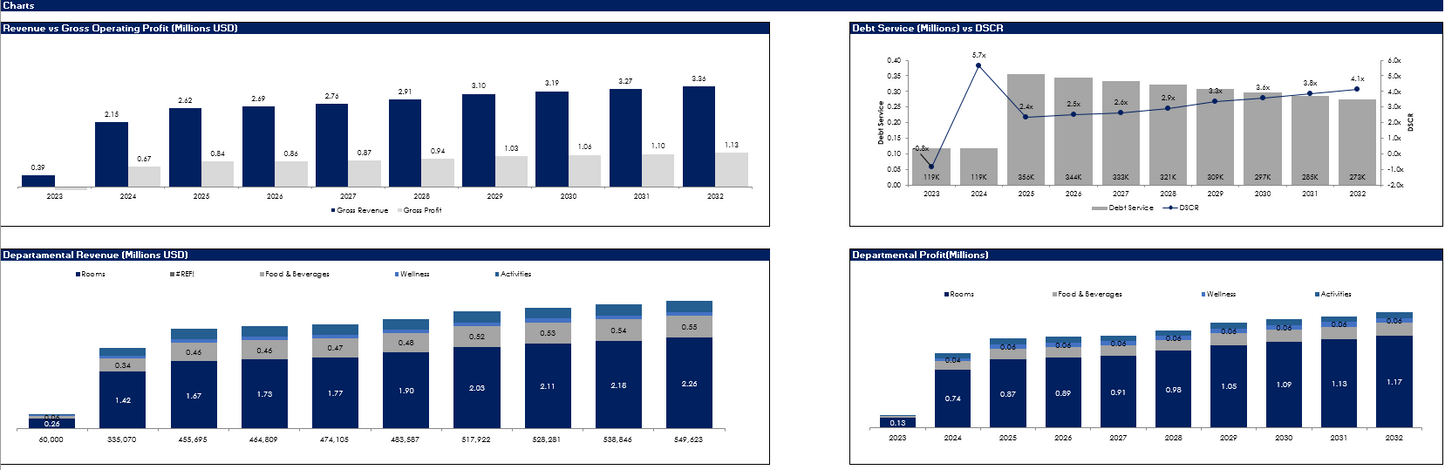

• Dynamic 10-Year Financial Forecast (3 Statement Model)

• Profitability Analysis per room type and operating year

• Breakeven Analysis per operating year

• Summary of various KPIs and Financial Ratios (ADR, Revpar, TRevPar, Occupied Rooms, Revenue & Cost Metrics, ROE, ROIC, Profit Margins, etc.)

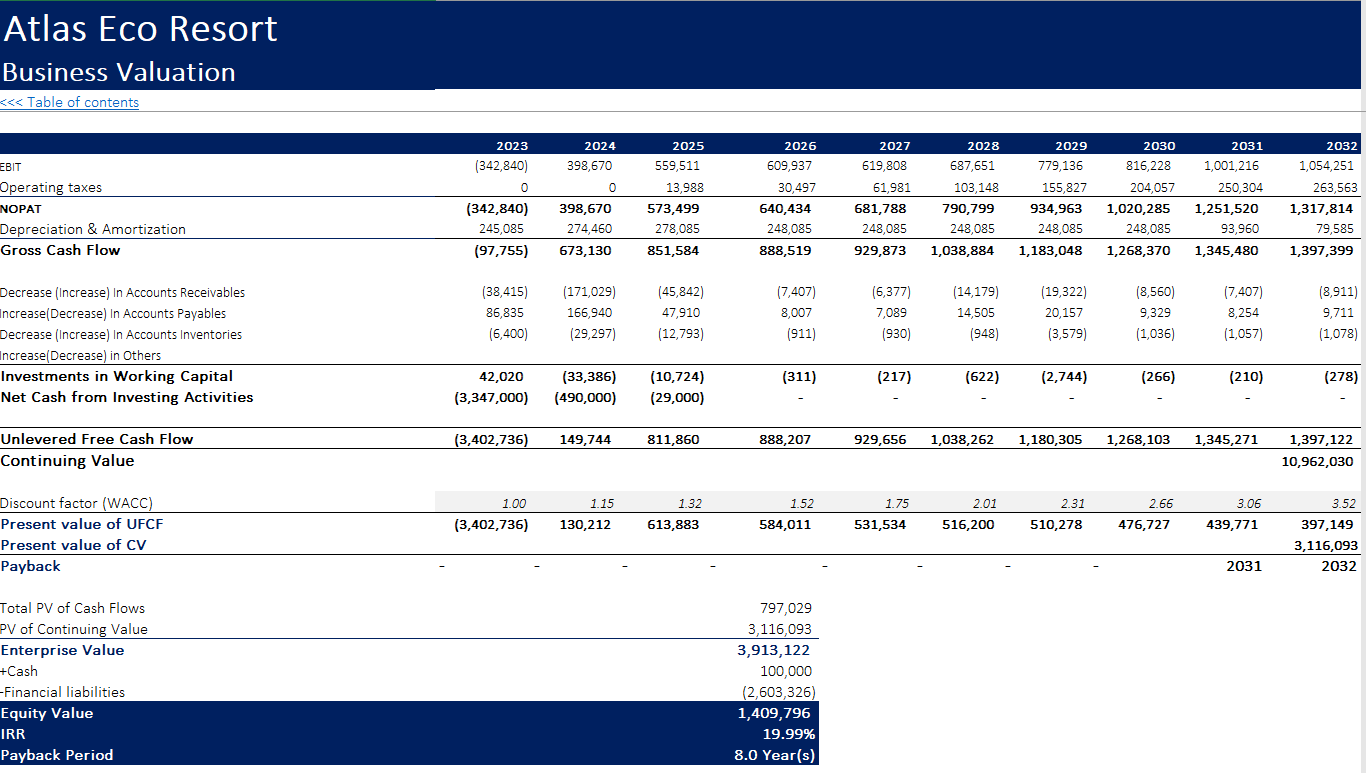

• Business Valuation

The model is expandable for up to 10 years and is 100% unlocked with transparent and easy-to-understand formulas that can be customized to the user's needs. The template is thoroughly adapted to the hospitality industry, considering the specificities and reporting standards of the sector.

The model includes assumptions and calculations of several Revenue streams (Accommodation, Wellness activities, Food, and beverage), Cost of Sales, Payroll and Operating Expenses, Capital Expenditures, financing through Debt & Equity, and Revolving facility to cope with the operating shortfall, especially in the initial years, and business valuation multiples.

Instructions and explanations on the model use are included in the Excel file.

Model Structure

Almost all the assumptions are set up in the input sheet, including the following:

• Revenue & Cost of Sales Assumptions, including Operating Days, Occupancy Rate, Room Types & Prices, Ancillary Services, and Direct Costs (Commissions to TAs, Room Expense, Discounts & Promotions, etc.)

• Payroll, OpEx & CapEx Assumptions

• Financing & Capital Structure – Uses & Sources of Cash analysis (Financing through Equity & Debt)

• TAX; VAT, WACC

Outputs:

• Dynamic 10-Year Financial Forecast (3 Statement Model)

• Profitability Analysis per room type and operating year

• Breakeven Analysis per operating year

• Summary of various KPIs and Financial Ratios (ADR, Revpar, TRevPar, Occupied Rooms, Revenue & Cost Metrics, ROE, ROIC, Profit Margins, etc.)

• Business Valuation