Bizz View

Private Equity Profit Distribution Waterfall Model

Private Equity Profit Distribution Waterfall Model

Regular price

$60.00 USD

Regular price

Sale price

$60.00 USD

Unit price

per

Couldn't load pickup availability

This Private Equity Profit Distribution Waterfall Model allows for the distribution of funds between the Limited Partners ('LPs') and the General Partner ('GP') for investment or private equity funds. This detailed model covers all the relevant concepts used in private equity cash flow models. The model follows a typical Private Equity Distribution Structure meaning that the funds are distributed over four steps (hurdles).

Return of capital (ROC) – 100% of distributions go to the investors until they recover their initial capital contributions.

Preferred Return – 100% of further distributions go to investors until they receive the preferred Return on their investment.

Catch-up – Assuming funding is available, cash flows go to the GP until it receives a certain percentage of profits from steps 2 and 3. The model also allows for setting the portion of the available funds that GP can retain until it has received its share of the gains.

Carried interest -The remaining proceeds are distributed to the LPs and GPs pro-rata according to the percentage defined for this step.

This waterfall model assumes only one GP and up to four LPs, which can be set with different hurdles rates and percentages of capital commitment. This model can be easily included in other models by linking the projects/assets CF in the portfolio CF section.

Template Structure (Three Sheets)

Input: The model inputs are set in this sheet, namely the fund sizes, equity contributions, debt ratio, fund life, commitment period, fund expenses, hurdle rate, fees, etc.

Dashboard Sheet: A dashboard contains the main KPIs of the funds, Investors, and Portfolio performance, as well as charts (eight) for better visualization.

CF Projection Sheet:

• Capital Call

• Debt Schedule

• Fees and Expenses Cfs

• Portfolio Cash Flows

• Calcs Perf Hurdles

• Waterfall

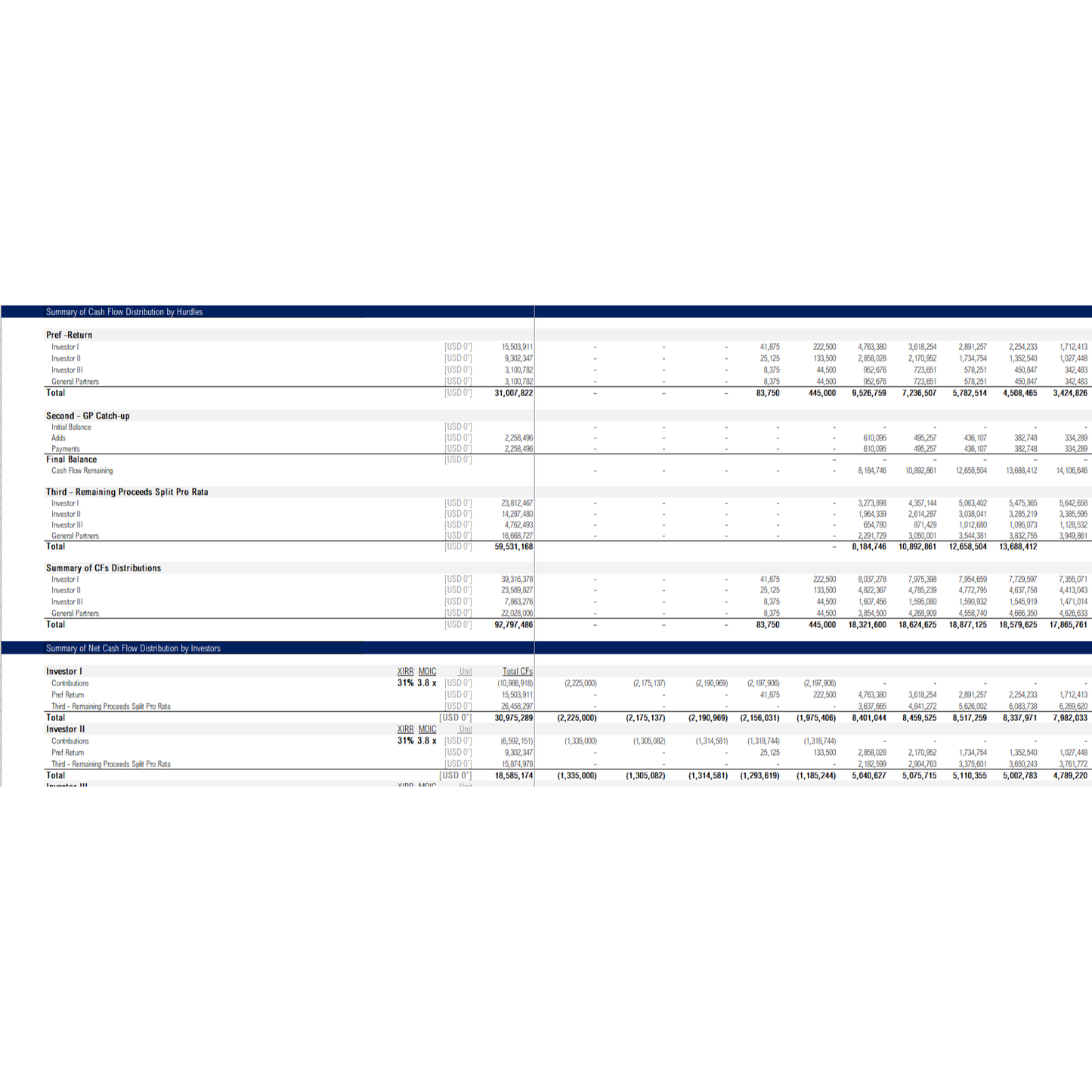

• Summary of Cash Flow Distribution by Hurdles

• Summary of Net Cash Flow Distribution by Investors

Model Options:

American vs. European Waterfall Models

The model is available for European and American waterfall (deal-by-deal) methods, and the users can easily toggle between the two modes.

Return of capital (ROC) – 100% of distributions go to the investors until they recover their initial capital contributions.

Preferred Return – 100% of further distributions go to investors until they receive the preferred Return on their investment.

Catch-up – Assuming funding is available, cash flows go to the GP until it receives a certain percentage of profits from steps 2 and 3. The model also allows for setting the portion of the available funds that GP can retain until it has received its share of the gains.

Carried interest -The remaining proceeds are distributed to the LPs and GPs pro-rata according to the percentage defined for this step.

This waterfall model assumes only one GP and up to four LPs, which can be set with different hurdles rates and percentages of capital commitment. This model can be easily included in other models by linking the projects/assets CF in the portfolio CF section.

Template Structure (Three Sheets)

Input: The model inputs are set in this sheet, namely the fund sizes, equity contributions, debt ratio, fund life, commitment period, fund expenses, hurdle rate, fees, etc.

Dashboard Sheet: A dashboard contains the main KPIs of the funds, Investors, and Portfolio performance, as well as charts (eight) for better visualization.

CF Projection Sheet:

• Capital Call

• Debt Schedule

• Fees and Expenses Cfs

• Portfolio Cash Flows

• Calcs Perf Hurdles

• Waterfall

• Summary of Cash Flow Distribution by Hurdles

• Summary of Net Cash Flow Distribution by Investors

Model Options:

American vs. European Waterfall Models

The model is available for European and American waterfall (deal-by-deal) methods, and the users can easily toggle between the two modes.