Bizz View

Real Estate Condo Development Model - With Pre-sold units (build & sell)

Real Estate Condo Development Model - With Pre-sold units (build & sell)

Couldn't load pickup availability

Model Options:

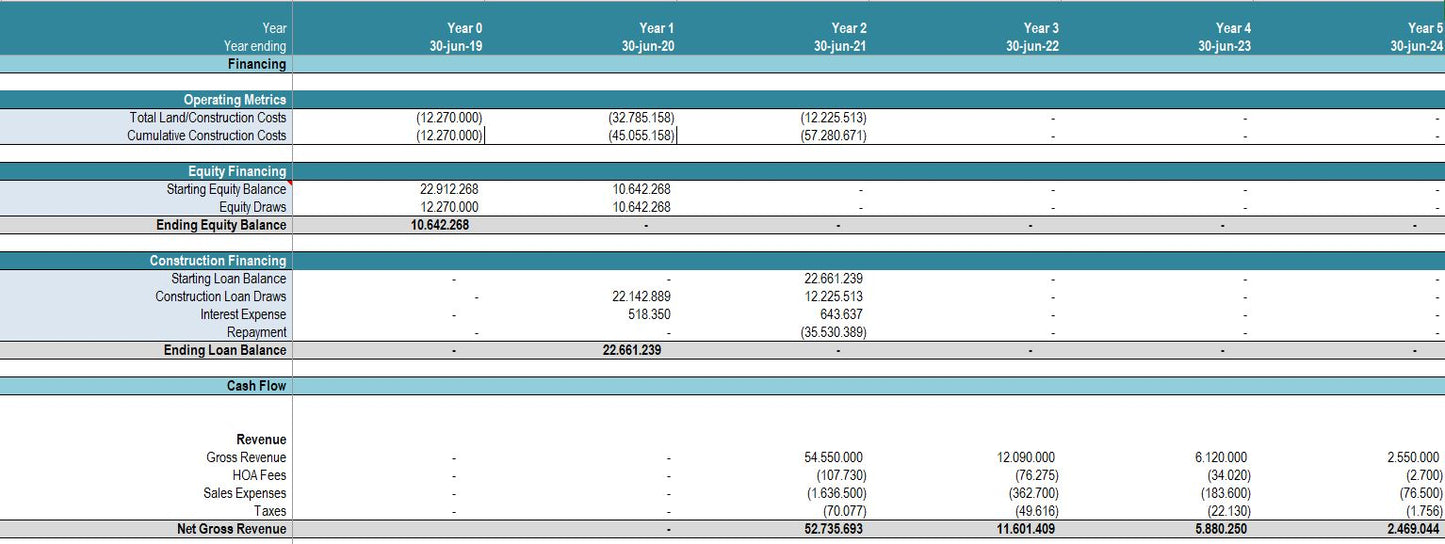

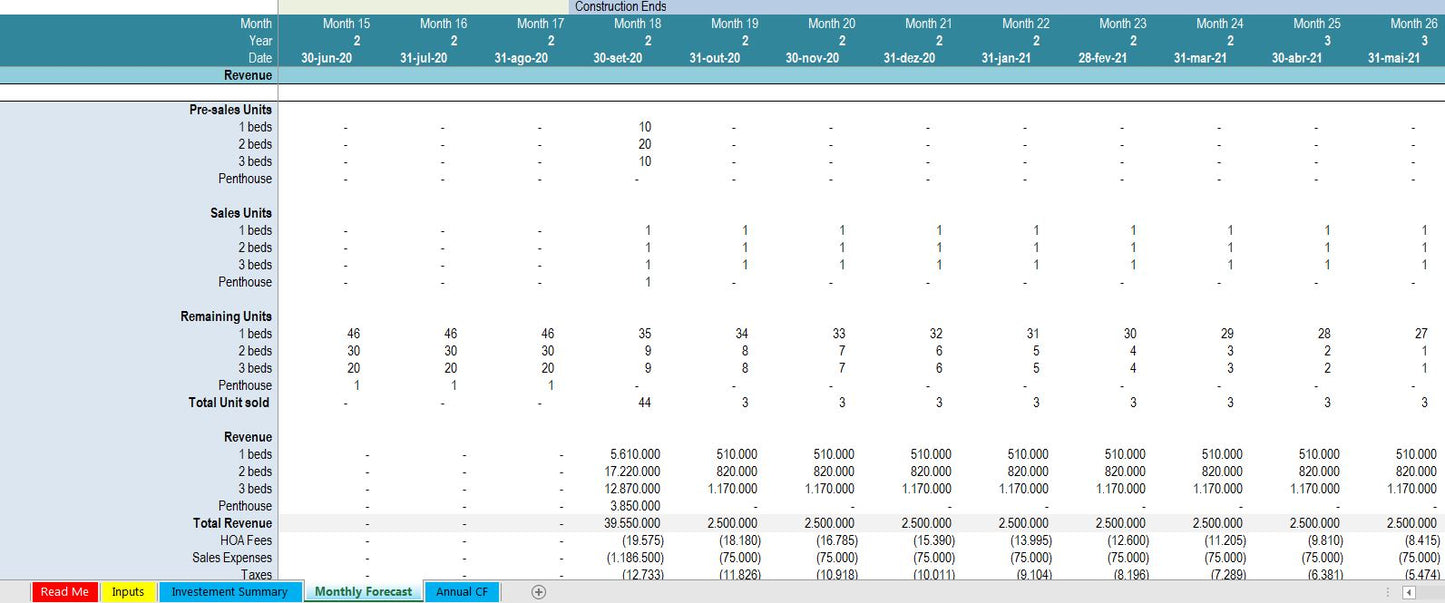

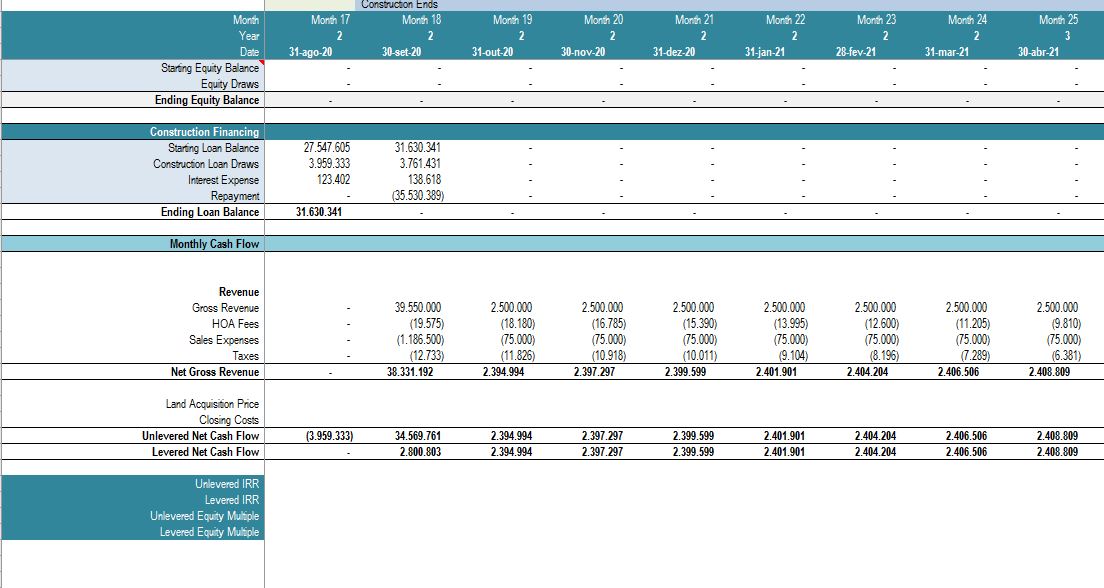

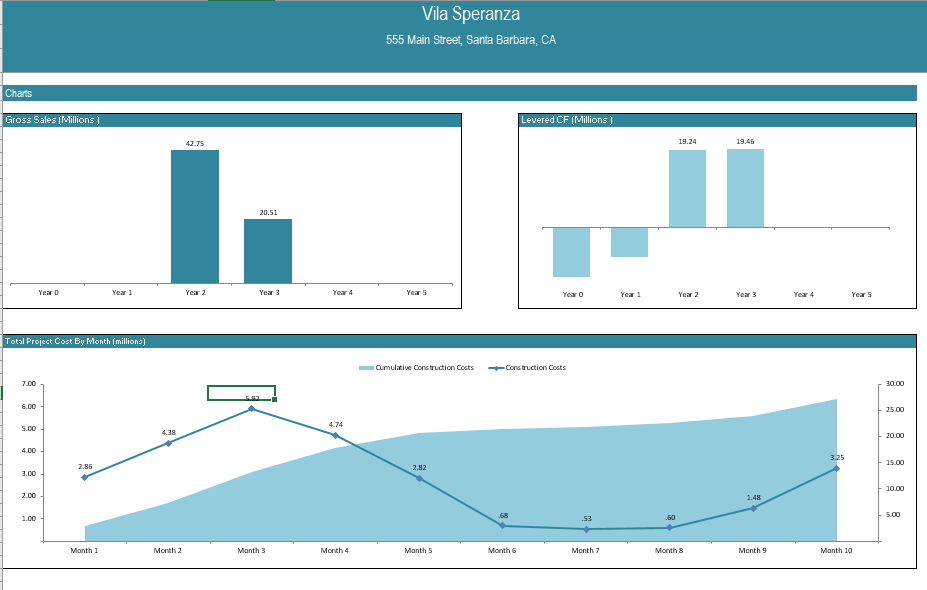

- Dynamic Monthly & Annual Cash Flow: Cash flows are projected monthly to calculate the key investment metrics needed to determine the project's feasibility.

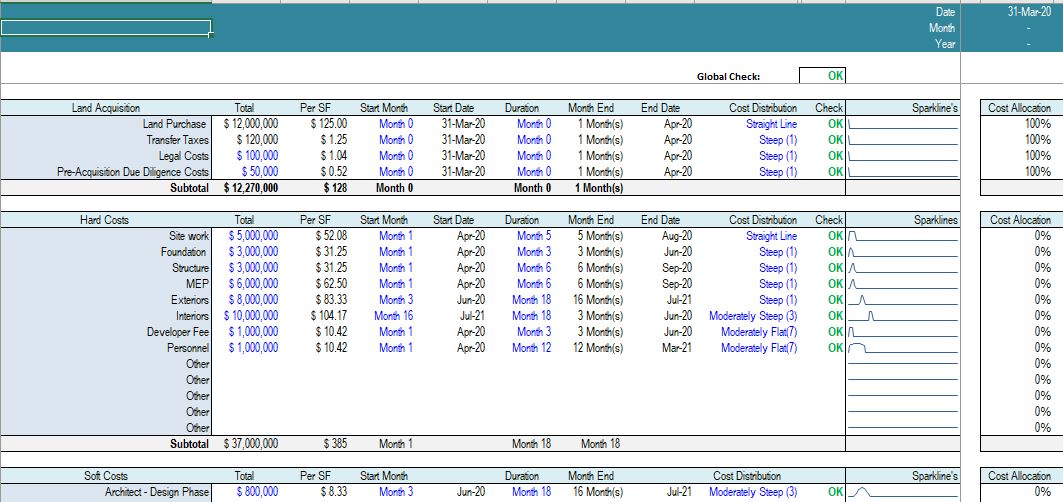

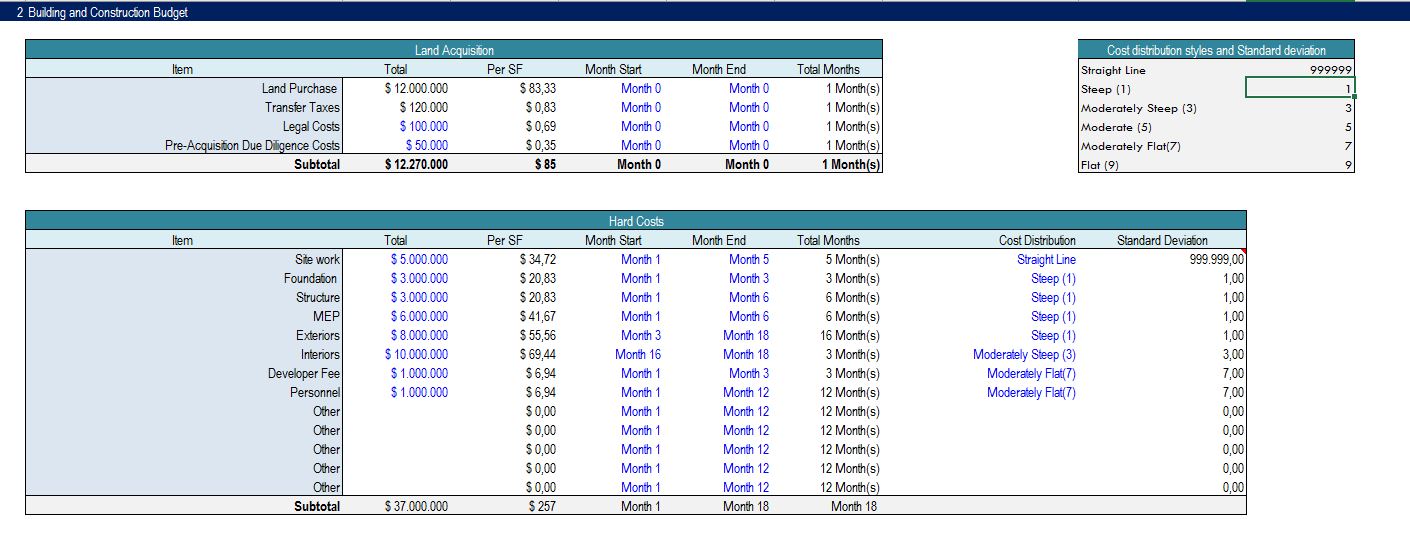

-Dynamic Construction Budget: The construction expenses can be modeled following an S-curve (normal distribution), meaning that expenses may be projected in a way that there are few expenses in the beginning, which then quickly ramp up, corresponding to a more realistic situation.

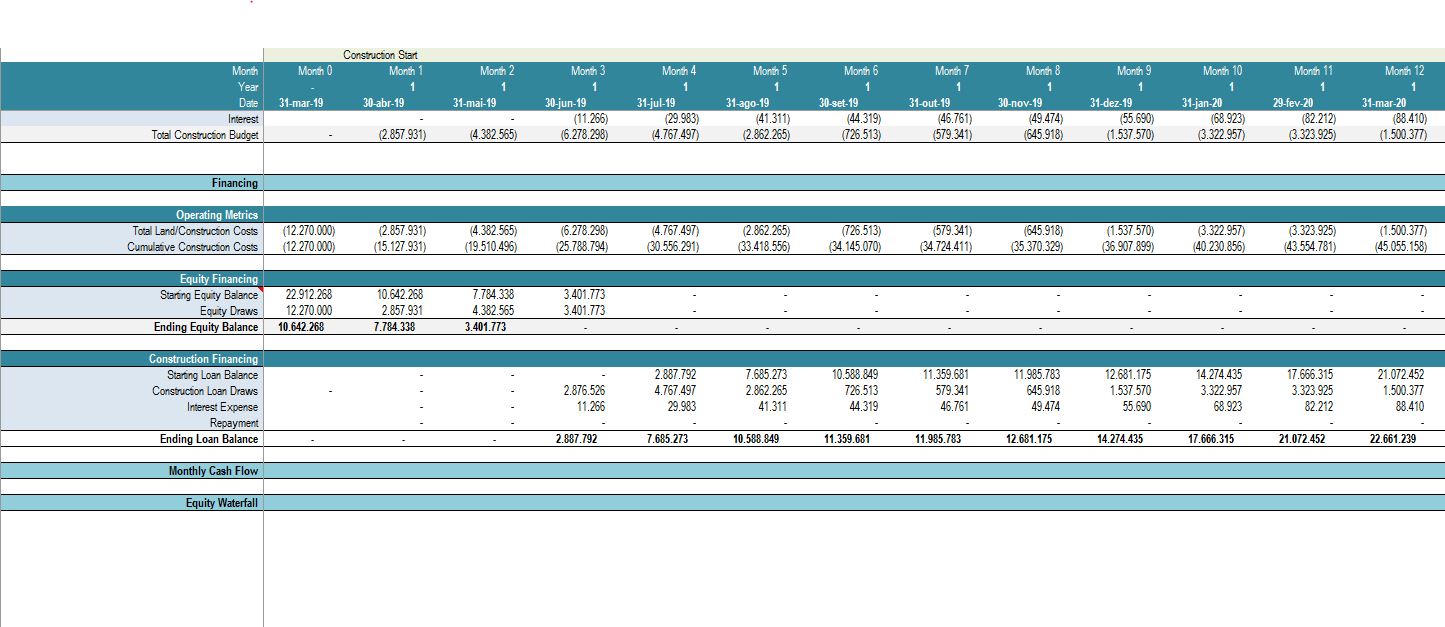

- Dynamic Equity Financing: The model works backward to determine the required amount and timing for equity and loan funding.

- Construction Loan: The model assumes that the construction expenses are first funded through equity and pre-sales deposits (if any), and then construction loan tranches are drawn for the remaining costs of the project.

-Monthly Cash Flow: This tab contains the construction cash flow, unlevered and levered CF, and the equity and debt draw schedule.

- Equity Waterfall Model: The template provides a four-tier equity waterfall model, allowing the user to determine how much capital the limited partner and general partner will receive, along with their respective rates of return.

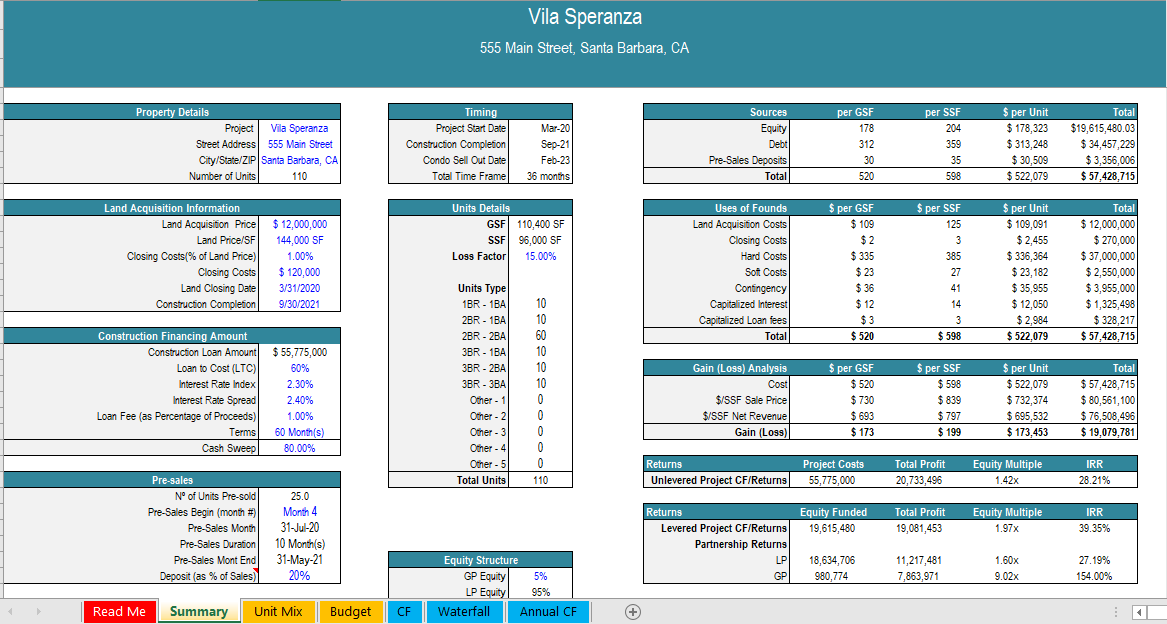

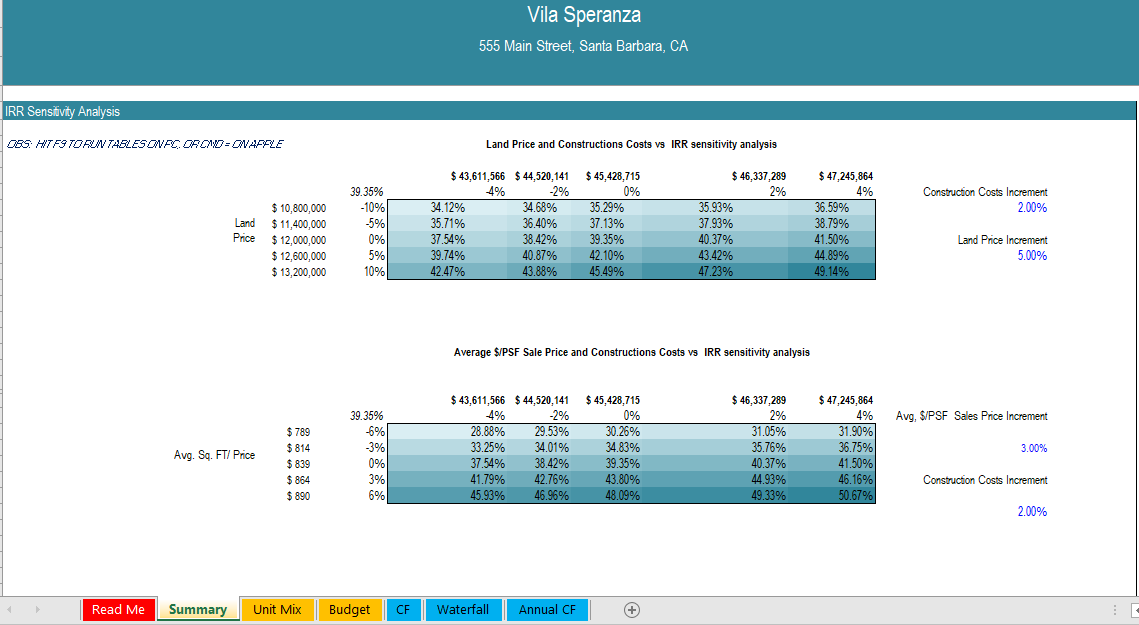

- Summary Sheet: Here, the user can perform Sensitivity Analysis using variations in the sale price, construction, and land acquisition costs.

Instructions:

THIS MODEL REQUIRES THAT MACROS ARE ENABLED. BE SURE TO ENABLE CONTENT AND ENABLE MACROS WHEN PROMPTED.

- The user only needs to input information into the cells formatted with dark blue font in the Investment Summary and Assumptions sheets. If the contents of a cell are in black font, it indicates that there is a formula. The yellow tabs indicate where the inputs are located, and the blue ones are for outputs only.

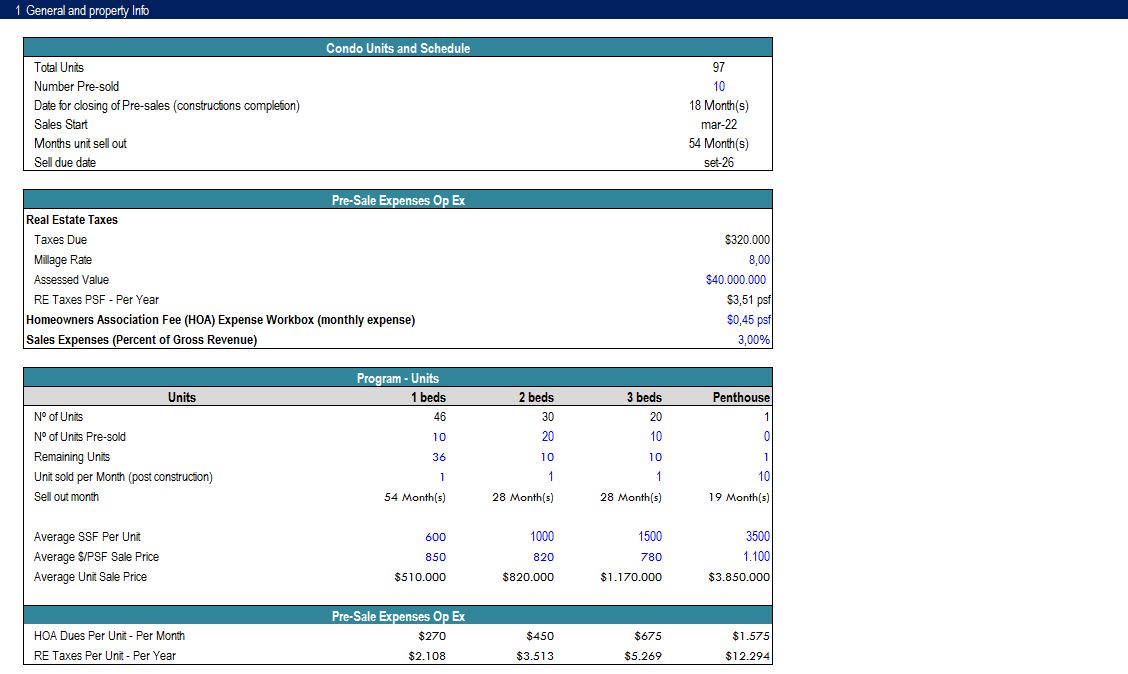

- The template contains information from a hypothetical property for demonstration purposes, which must be erased.- The Summary Sheet overviews the property and several key metrics.

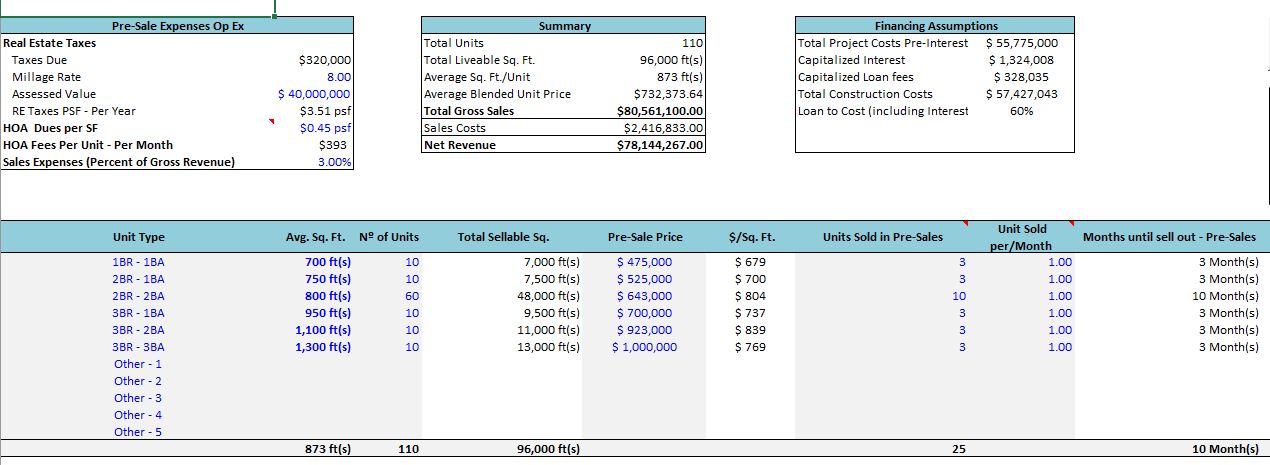

- In the Unit Mix, the user can define information related to the units, namely the type, sale price for pre-sales and market sales, the pre-sold units, the average sale price per square foot for the different unit types, and the absorption schedule (units sold per month), etc. Also, in this sheet, the user must, after completing all the inputs, run the macro to paste the values of capitalized interest and loan fees, which are funded through the loan itself.

- The maximum horizon for this model is five (5) years.