Bizz View

Real Estate – Multi Family Acquisition Pro-forma

Real Estate – Multi Family Acquisition Pro-forma

Regular price

$50.00 USD

Regular price

Sale price

$50.00 USD

Unit price

per

Couldn't load pickup availability

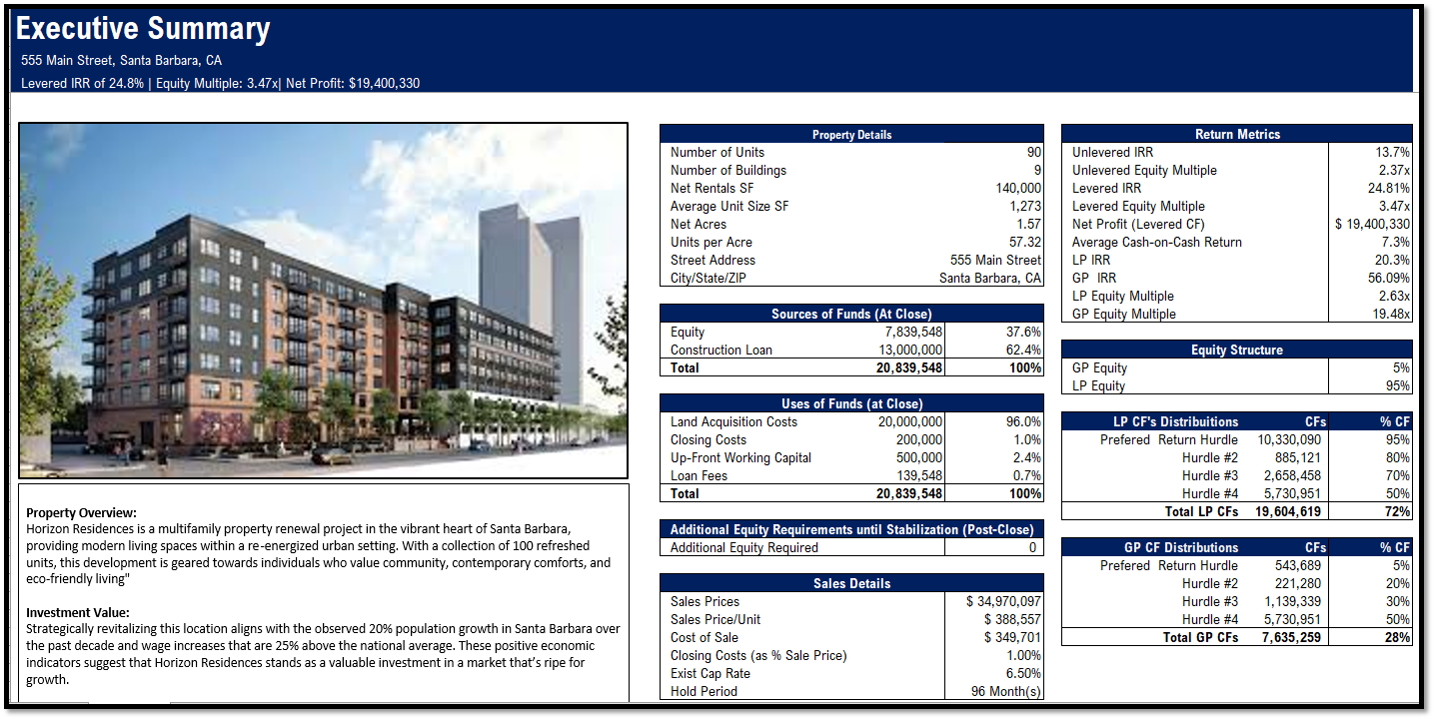

This Excel template is an intuitive and comprehensive solution tailored for evaluating the financial viability of multifamily property investments. Crafted with institutional-grade precision, it features a dynamic financial model streamlining the analysis of multifamily acquisitions for hold(rent) and subsequent sale. The template offers a detailed financial model that thoroughly examines investment prospects in multifamily properties.

Model Features Include:

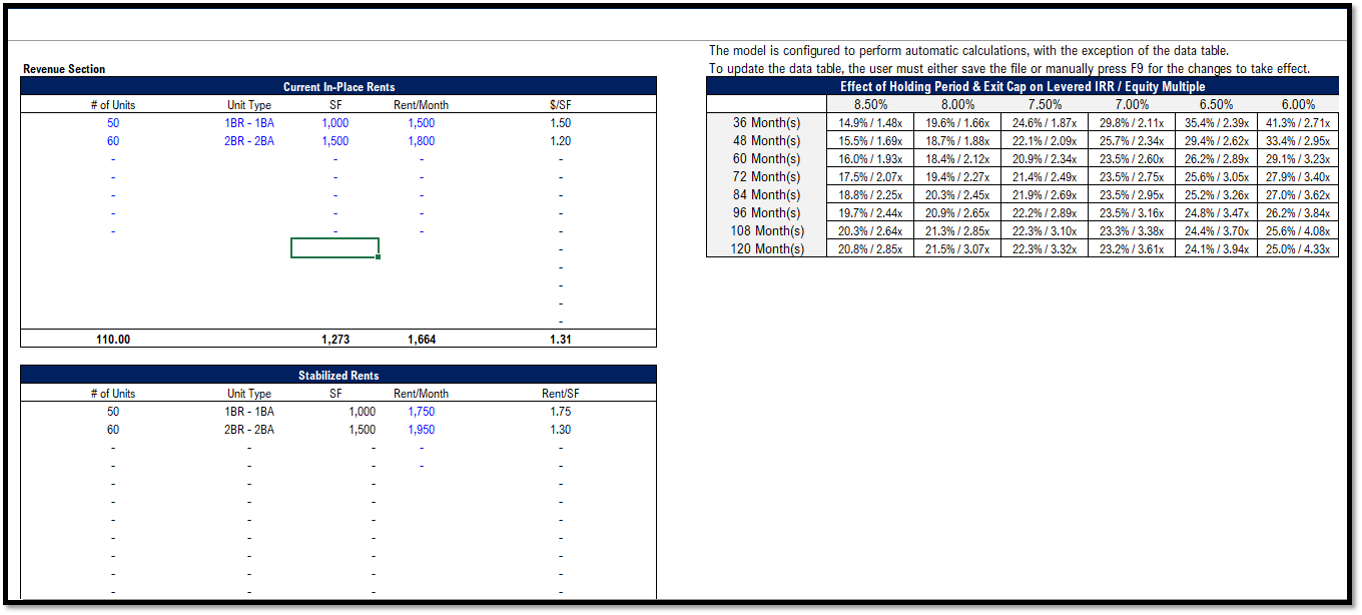

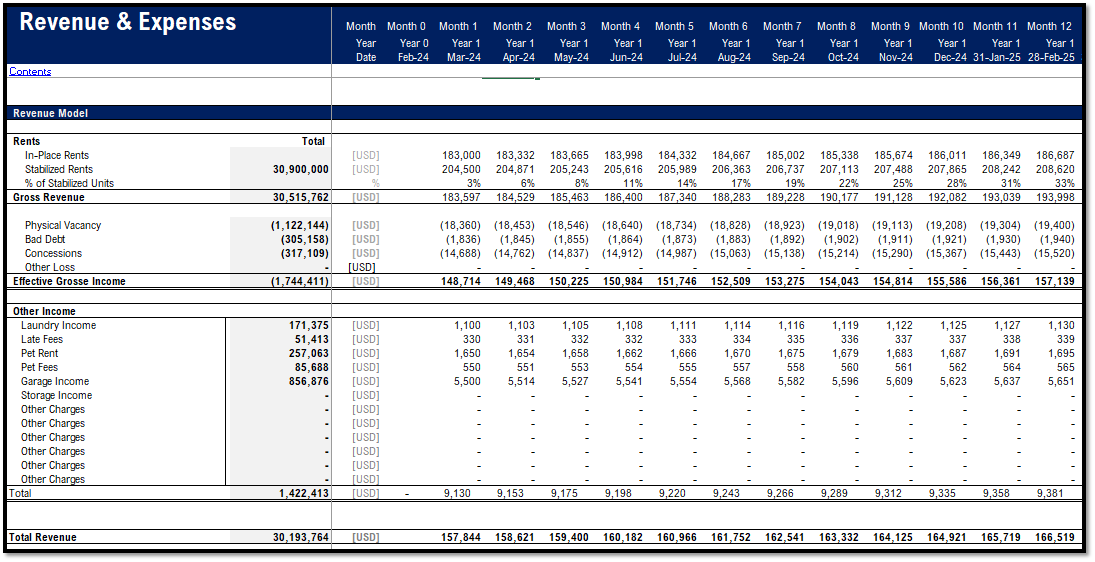

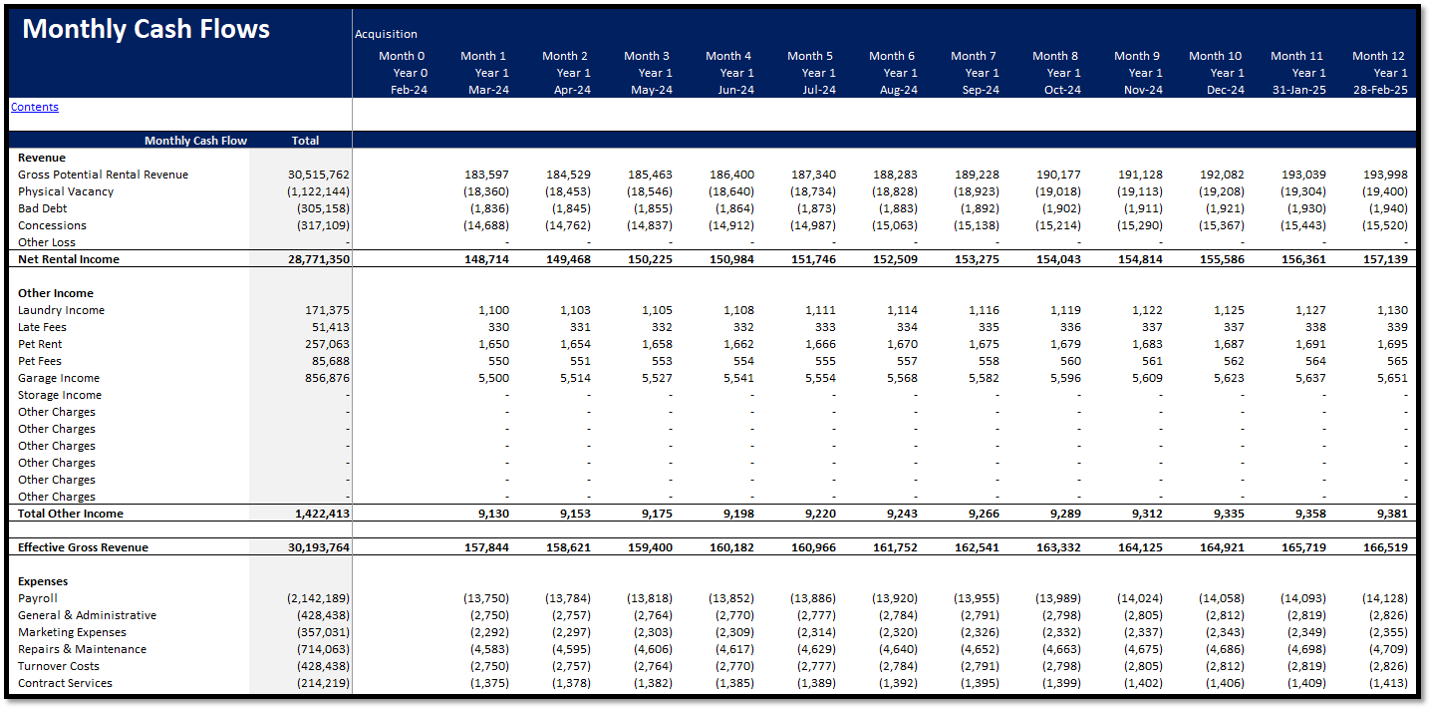

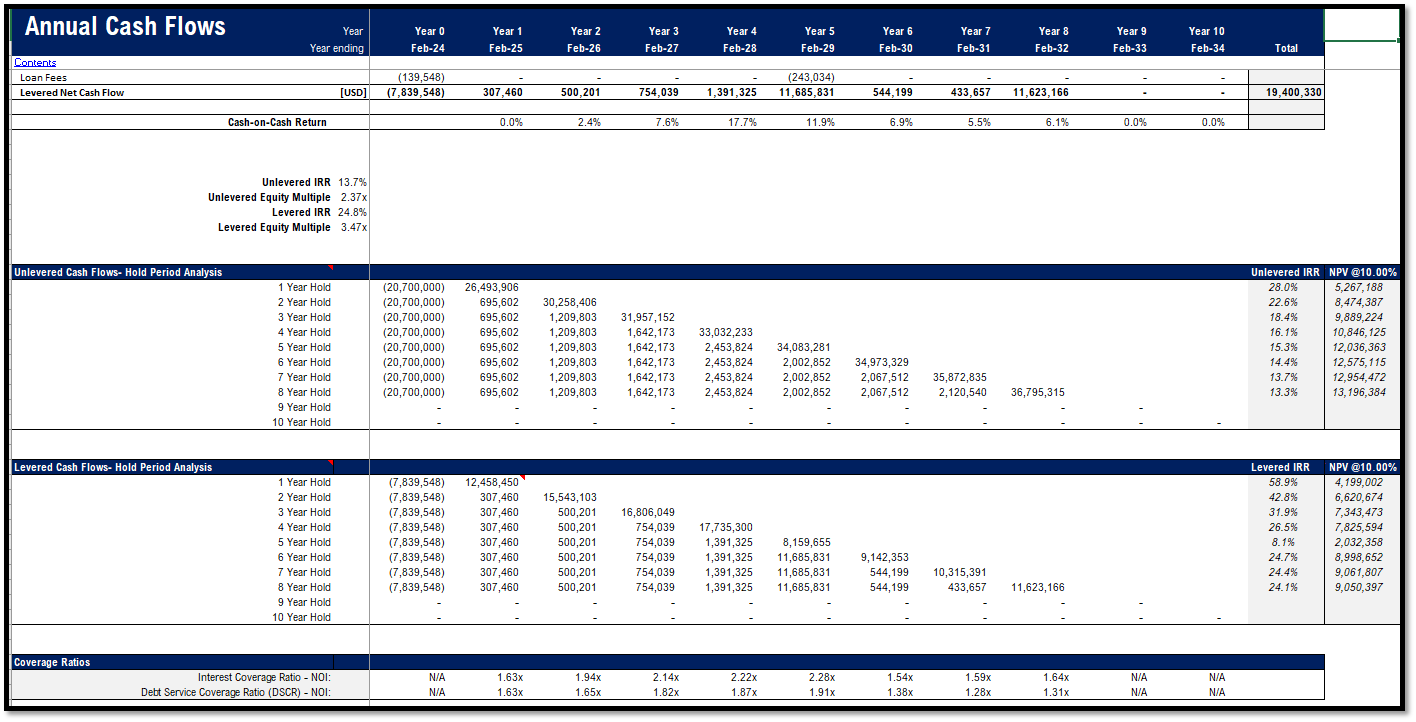

- Dynamic Cash Flow Analysis: Provides monthly and annual projections to calculate key investment metrics, determining project viability and potential resale value.

- Lease Ramp-up: Includes a lease-up forecast in sync with the renovation period, offering a realistic financial outlook during the renovation phase.

-

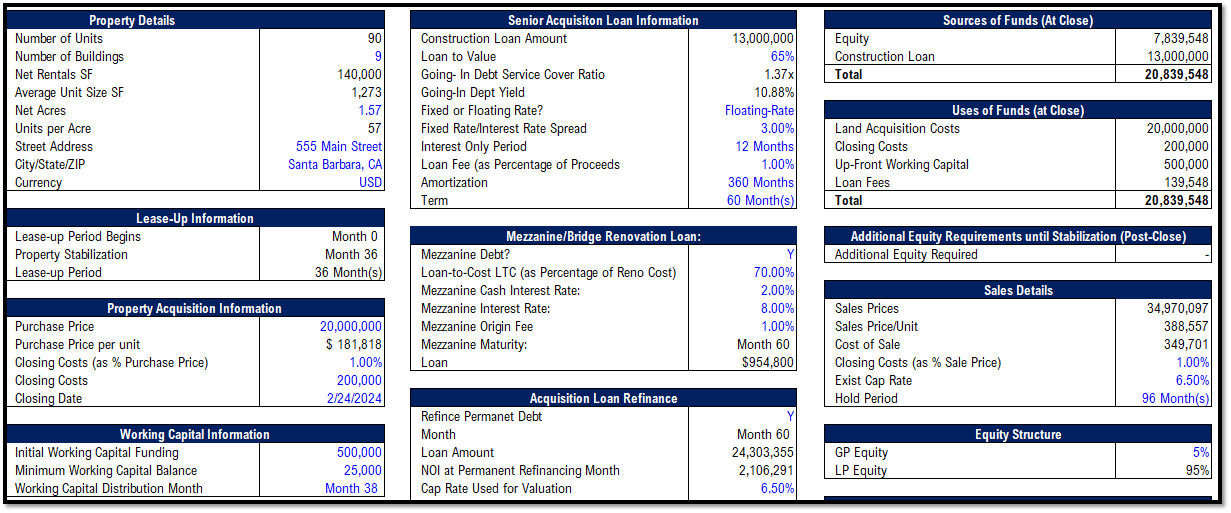

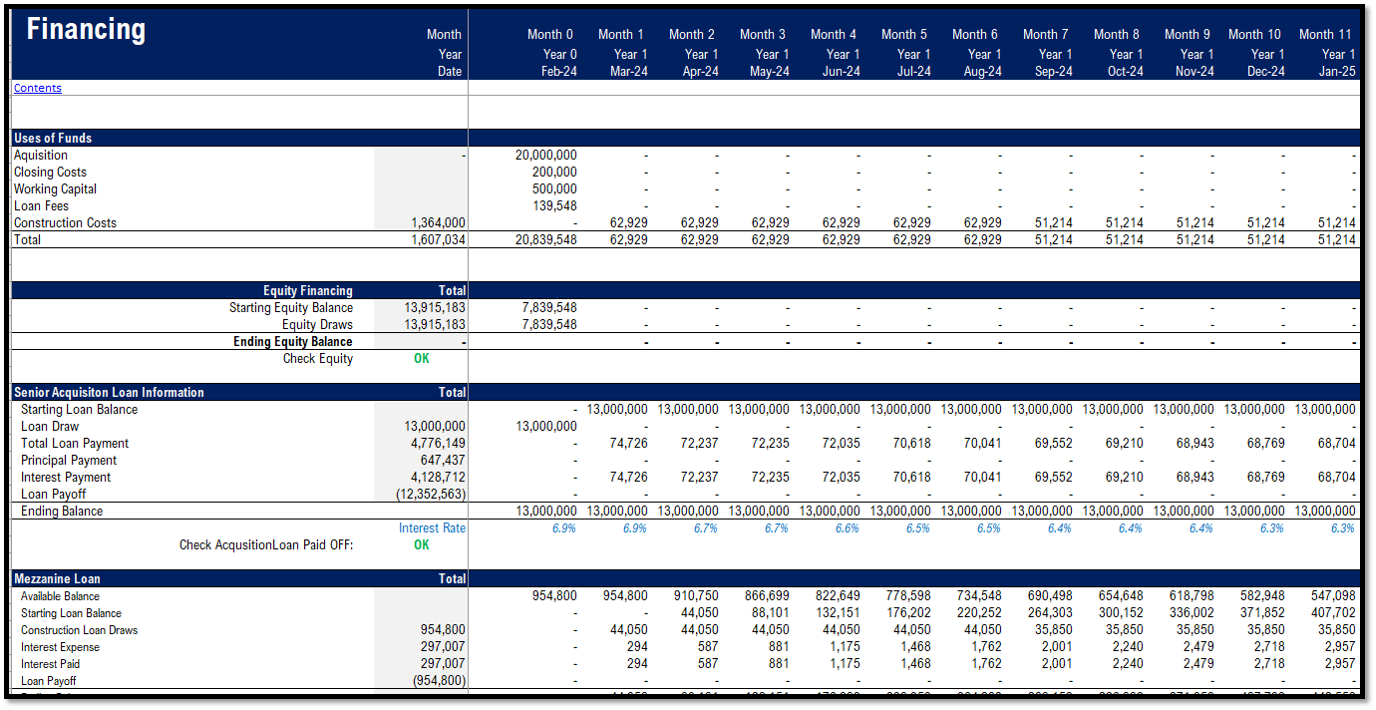

Debt Financing Options: Presents three adaptable debt options to accommodate various project needs:

- Acquisition Loan: Finances the purchase of the property.

- Mezzanine Loan: Optional subordinate financing for a portion of the renovation capital expenditure.

- Refinancing Option: Allows for restructuring acquisition debt to secure better terms.

-

Capital Stack Framework:

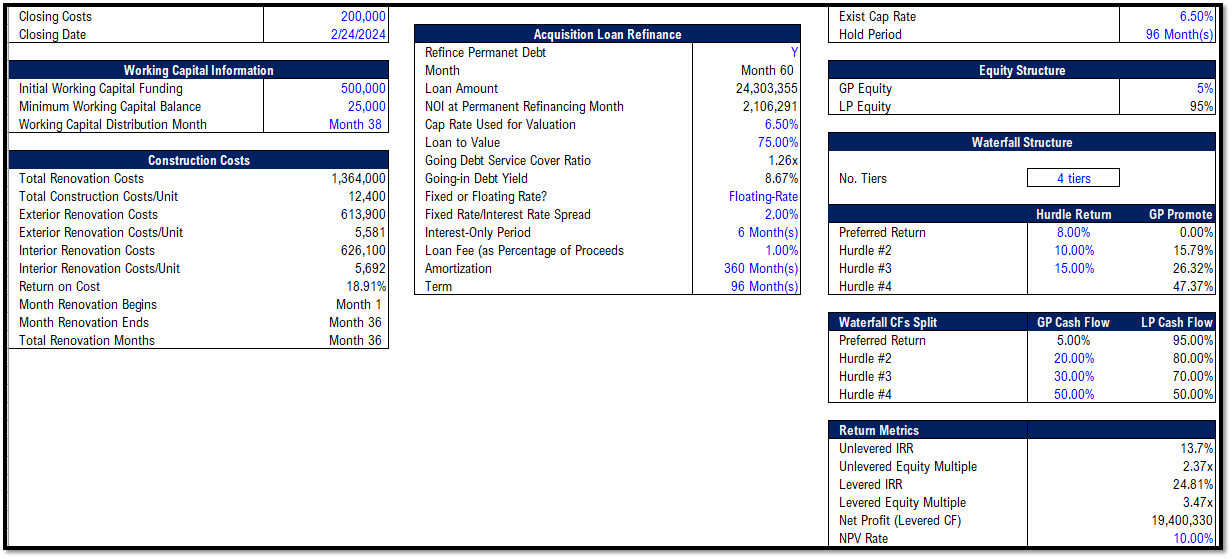

- Funding Strategy: At property closing, funding is secured through equity and an acquisition loan.

- Mezzanine Loan Structure: A subordinate financing layer with flexible interest options for renovation capital needs is offered.

- Working Capital Feature: Addresses any extra funding requirements. The mode assures the refunding of unused amounts to equity holders at the end of a predetermined period.

- Acquisition Loan Refinance: This enables users to refinance the initial loan based on the inputs provided in the sheet.

- Equity Waterfall Analysis:

-

- The waterfall distribution function allows users to select between two to four tiers for allocating capital among limited and general partners.

-

Instructions for Use:

- Data entry is required only in cells highlighted with a dark blue font within the 'Investment Summary' and 'Assumptions' sheets. Cells in black text contain formulas.

- It comes with sample data for illustrative purposes, which should be replaced for real property analysis.

- The 'Investment Summary' sheet delivers a concise property overview featuring essential metrics and assumptions.

- Most of the parameters can be defined in the 'Input' sheet.

- The model is designed to support analysis for up to ten years.

- The 'Construction Budget' allocations are made across different categories in the 'Reno' sheet.